The most common business structure in India, particularly for new and expanding enterprises, is a Private Limited Company Registration (Pvt. Ltd.). It is perfect for growing a business because it offers advantages like limited liability, a distinct legal identity, and simpler access to capital and investors. Understanding the cost of company registration in India and the total registration fees for a Private Limited Company prior to launching their business is one of the most frequent questions asked by aspiring entrepreneurs.

The Companies Act of 2013 and the Ministry of Corporate Affairs (MCA) regulate the process of registering a private limited company. With a maximum of 200 shareholders, a company must have two directors and two shareholders, who may be the same people. Since registration entails government fees, professional charges, and stamp duty depending on the authorized capital and state of registration, many new business owners also investigate the cost of incorporating a company in India.

Getting a Digital Signature Certificate (DSC), a Director Identification Number (DIN), approving a company name, creating the Memorandum of Association (MOA) and Articles of Association (AOA), and submitting incorporation forms to the MCA are all done online.

Businesses obtain legal recognition, limited liability, tax benefits, credibility, and expansion prospects by completing the registration process. Entrepreneurs can better plan their budgets and begin the process of creating a scalable, legally compliant business by being aware of the company registration fees in India up front.

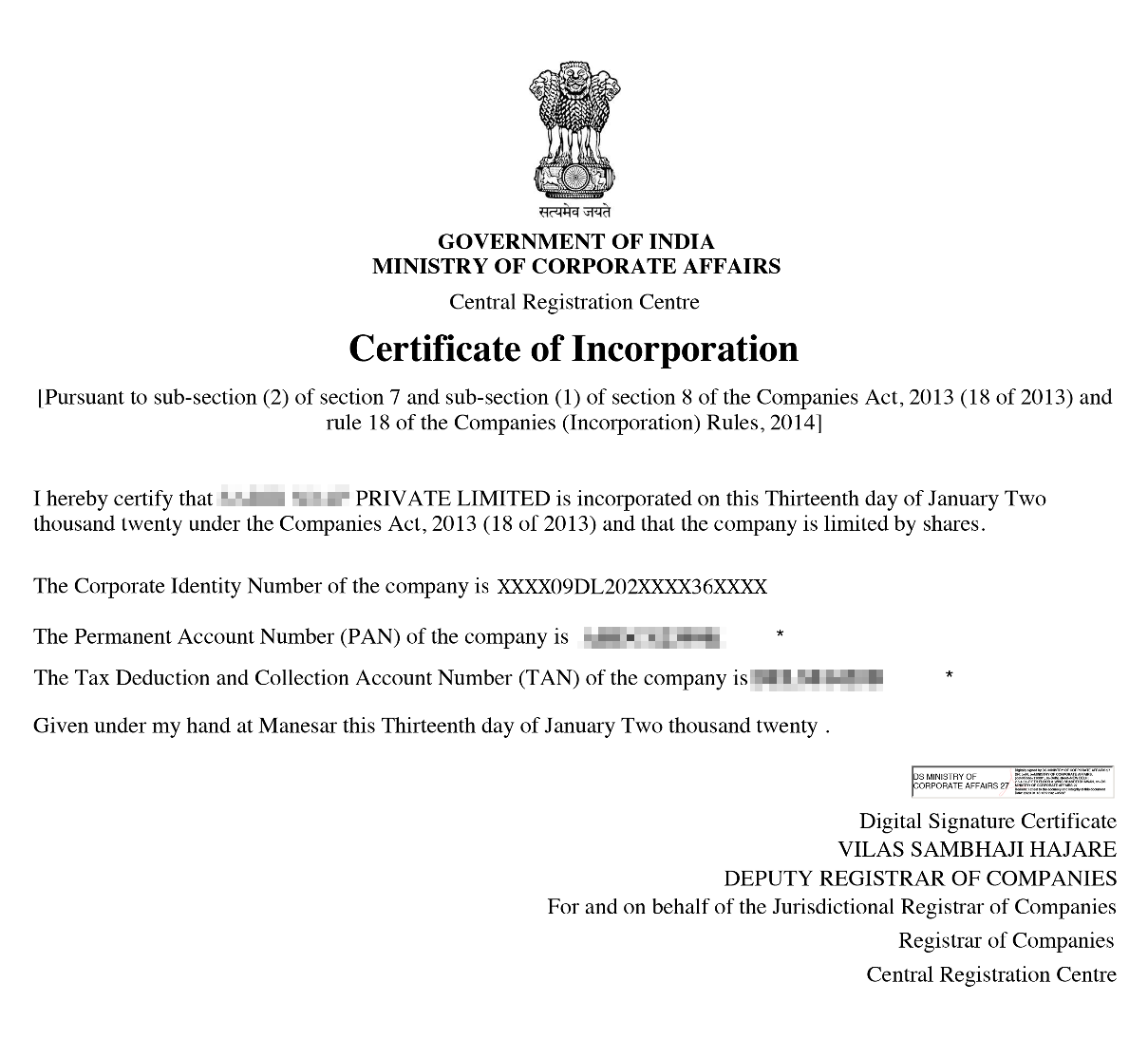

Private Limited Company - Incorporation Certificate [Sample]

Table of Content

A Private Limited Company is one of the most preferred forms of business incorporation among various startup founders and entrepreneurs in India and other states as well.

Registering your business as a private limited company gives it more stability and authoritativeness in the eyes of customers, investors and other stakeholders.

A registered business will ensure a stable structure and compatibility for its long term growth. A private limited company registration comes with various benefits such as separate legal entity, perpetual existence, limited liability etc.

Given below is the complete registration process of a Private Limited (Pvt Ltd) company in India, outlining the key steps involved in the private limited company process from documentation to approval.

As part of the company incorporation process, it is important to obtain a Digital Signature Certificate from the government for the online company registration Process. A DSC or a Digital Signature Certificate works as proof of identity of the director of the company and it is required to sign digital forms while registering for the company incorporation online.

The next step after getting DSC is to apply for a Unique name for your business as the business name cannot be identical or same as any other registered business as per the details mentioned in Rule 8 of the company Incorporation Rules.

You can use our Name Search tool to check for the availability of the unique name for your private limited company.

After the name approval, the details of the company registration have to be drafted in the SPICe+ form on the MCA portal. It is a detailed Proforma for registering a private limited company online in Bangalore. You are required to fill in all the details mentioned below.

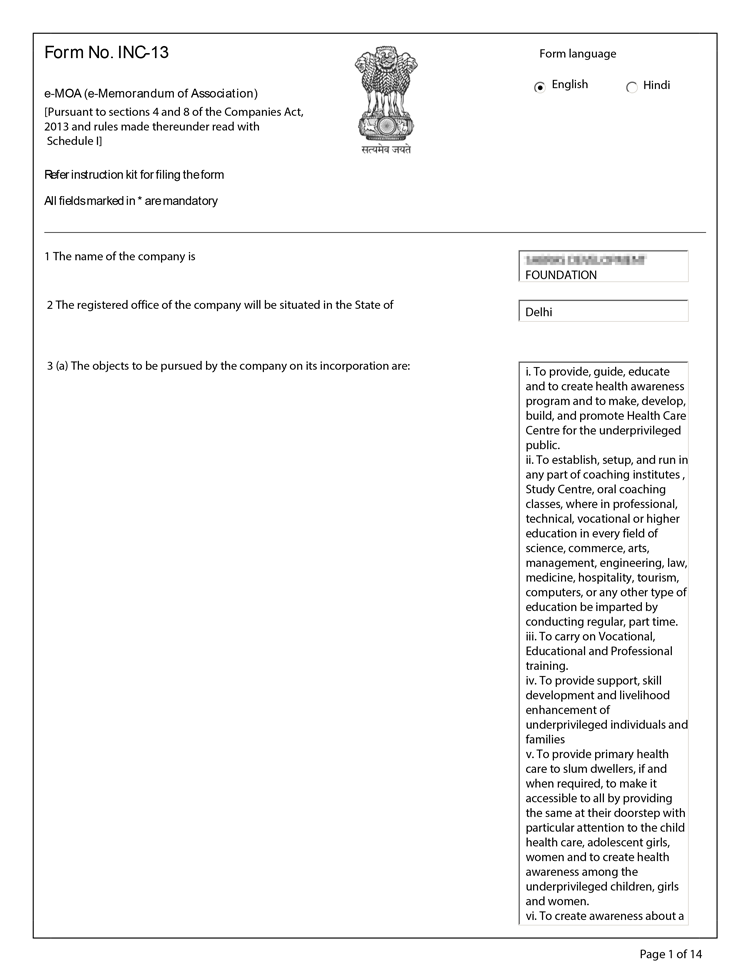

SPICe e-MoA (INC-33) and e-AoA (INC-34) are the forms which have to be drafted while applying for online company registration in Bangalore. MoA is defined under section 2(56) which tells about the objectives and goals of the company and AoA is defined under section 2(5) of the Companies Act, 2013, which defines the internal working and management structure of the company.

Post approval of the aforementioned documents from the Ministry of Corporate Affairs, the department will issue documents such as PAN, TAN, Certificate of Incorporation, etc.

Businesses evaluating jurisdictional considerations may also review compliance aspects applicable to a private limited company in Karnataka where relevant.

| Section 8 Company Registration State Wise | Registration Fees |

|---|---|

| ✅ Andhra Pradesh | ₹9,499 |

| ✅ Arunachal Pradesh | ₹9,499 |

| ✅ Assam | ₹9,499 |

| ✅ Bihar | ₹11,499 |

| ✅ Chhattisgarh | ₹11,499 |

| ✅ Dadra & Nagar Haveli | ₹9,499 |

| ✅ Daman & Diu | ₹9,499 |

| ✅ Delhi | ₹9,499 |

| ✅ Goa | ₹9,499 |

| ✅ Gujarat | ₹9,499 |

| ✅ Haryana | ₹9,499 |

| ✅ Himachal Pradesh | ₹9,499 |

| ✅ Jammu & Kashmir | ₹9,499 |

| ✅ Jharkhand | ₹9,499 |

| ✅ Karnataka | ₹19,499 |

| ✅ Kerala | ₹11,499 |

| ✅ Ladakh | ₹9,499 |

| Section 8 Company Registration State Wise | Registration Fees |

|---|---|

| ✅ Madhya Pradesh | ₹16,499 |

| ✅ Maharashtra | ₹10,999 |

| ✅ Manipur | ₹9,499 |

| ✅ Meghalaya | ₹9,499 |

| ✅ Mizoram | ₹9,499 |

| ✅ Nagaland | ₹9,499 |

| ✅ Odisha | ₹9,499 |

| ✅ Puducherry | ₹9,499 |

| ✅ Punjab | ₹19,499 |

| ✅ Rajasthan | ₹16,499 |

| ✅ Sikkim | ₹9,499 |

| ✅ Tamil Nadu | ₹9,499 |

| ✅ Telangana | ₹11,499 |

| ✅ Tripura | ₹9,499 |

| ✅ Uttarakhand | ₹9,499 |

| ✅ Uttar Pradesh | ₹9,499 |

| ✅ West Bengal | ₹9,499 |

Note: The aformentioned Fees is exclusive of GST.

Note - The above mentioned state wise registration fees includes registration for 2 members with minimum Authorised capital of Rs 1,00,000, DSC, Government Fees(Stamp Duty) and Professional fees. The fees may vary if the number of members or Capital is increased or decreased.

The list of documents required for private limited(Pvt Ltd) company registration is given below:

Note : A residential address can also be used for registering a private limited company if the company does not own a commercial space.

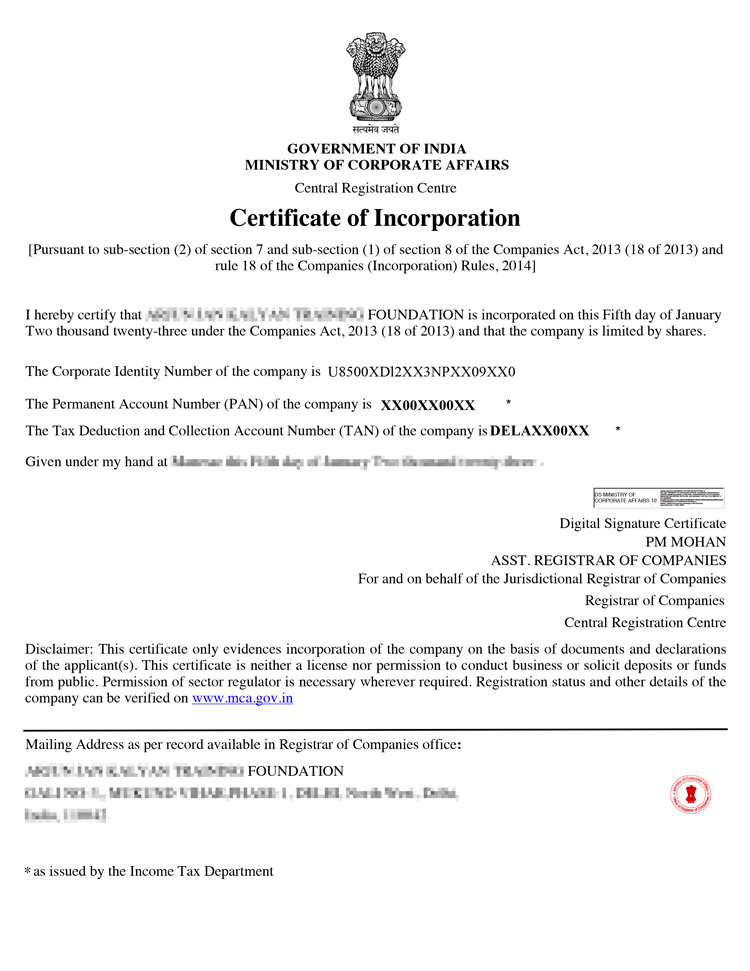

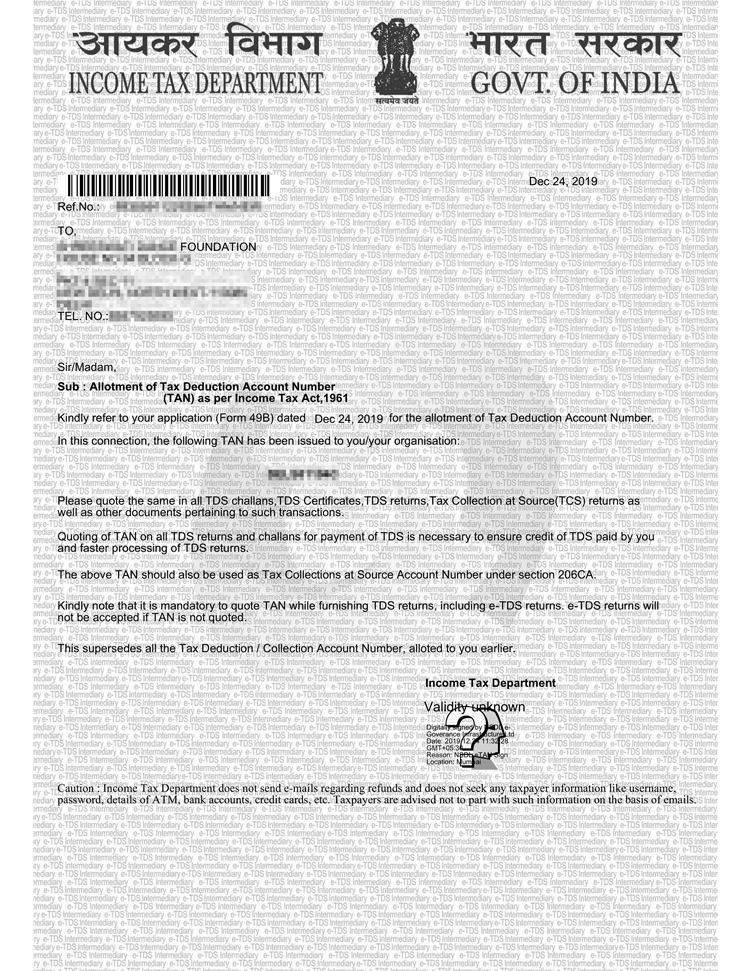

After successful registration of Private Limited Company with the Ministry of Corporate Affairs (MCA), your company receives a set of official incorporation documents that confirm its legal status and allow it to conduct business in India.

The main documents issued after it in India are:

Certificate of Incorporation Sample

PAN Card Sample Documents

TAN Sample Documents

AoA Certificate Sample Documents

MoA Certificate Sample Documents

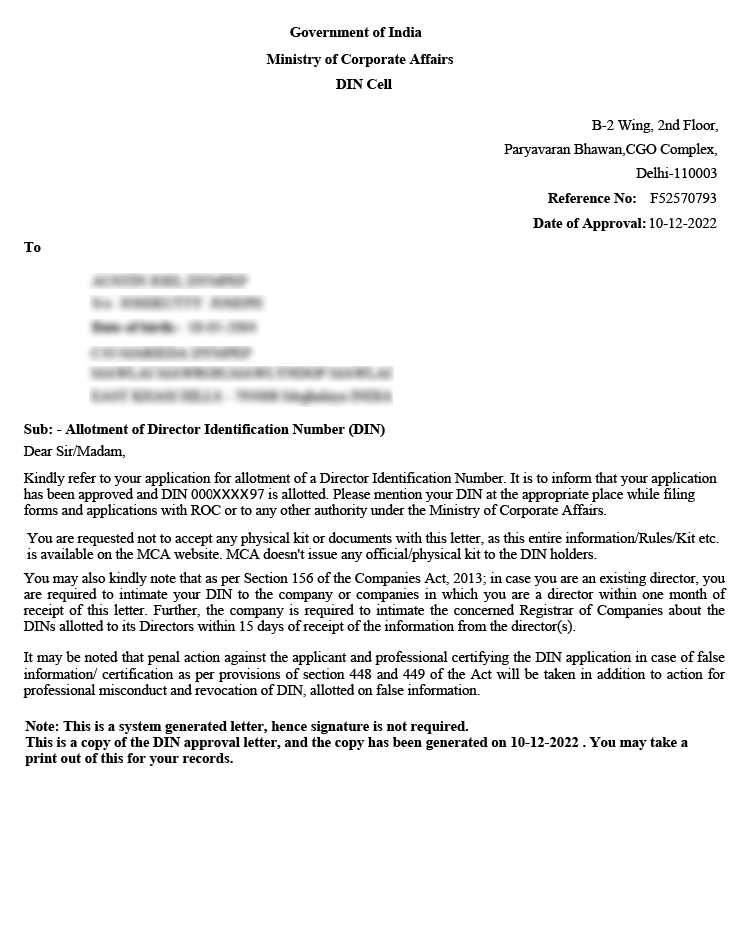

DIN Certificate Sample Documents

DSC Sample Documents

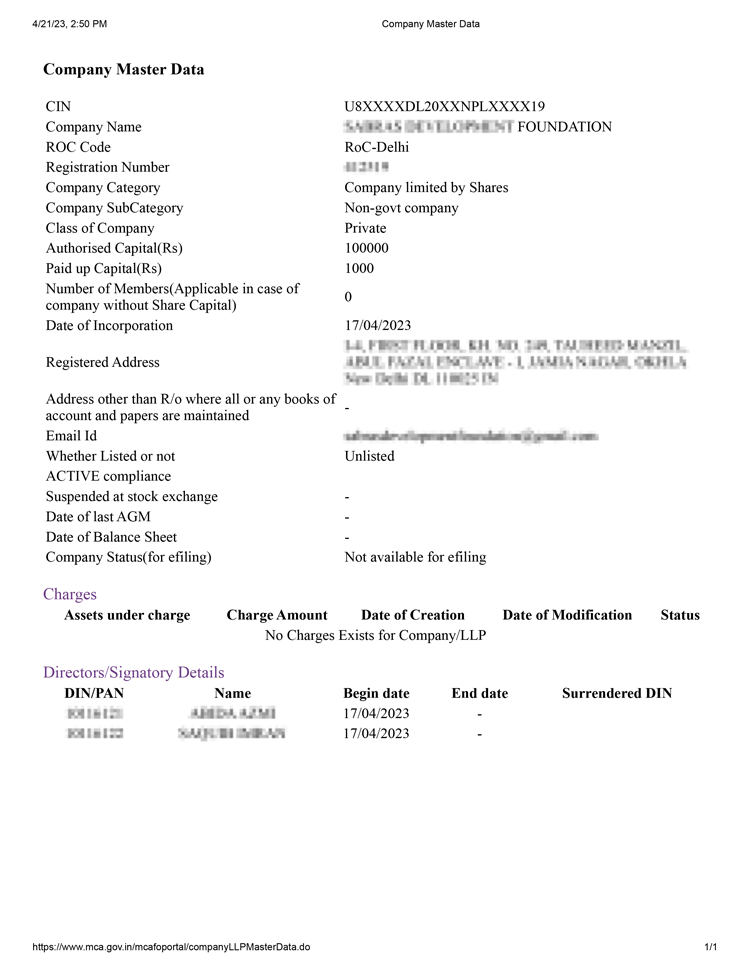

Master data Sample Documents

As per the rules and procedures led by the Ministry of Corporate Affairs there are some minimum requirements for a private limited company registration online in India which are mentioned below:

Minimum 2 directors

Unique business name

At least one director should be the resident of India

Registered office address

The usual time taken for Private Limited (Pvt Ltd) Company registration in India is around 7-10 working days, which is typical for businesses planning to register pvt ltd company through the MCA portal.

Conclusion

If you are looking to establish a small business with limited liability, registering as a private limited company could be the right choice for you. It provides legal protection, credibility, and can make it easier to raise capital through structured options discussed under private limited company funding, which can help your business succeed in the long term.

Private Limited Company registration is a highly beneficial business entity structure in India. The registration process involves submitting various documents on the govt portal.

Businesses operating across jurisdictions may also align their compliance planning with requirements applicable to a private limited company in Maharashtra where relevant.

For proper guidance and advice, private limited company registration fees, consult experts at Professional Utilities

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Yes, it is possible to change AOA and MOA of a company through the Board Resolution and taking consent from the shareholders as well.

The registration fee for a Private Limited Company in India typically starts from ₹6,000 and can go up to ₹30,000 or more, depending on factors like the authorized capital, state of registration, professional charges, and government fees, with early cost planning often beginning at the stage of pvt ltd company name approval.

To register a Pvt Ltd company , obtain DSC and DIN, reserve a company name, file SPICe+ forms with required documents on the MCA portal, and get the Certificate of Incorporation (COI).