Import and Export Code consultants in Madhya Pradesh are a vital asset for businesses seeking to expand into international trade. Businesses rely on them to assist with international trade requirements, such as navigating foreign trade policies, custom services, GST consulting, etc. Import export code Registration are necessary for businesses and manufacturers to trade internationally.

The Importer Exporter Code (IEC) is a crucial identification number for customs authorities all over the world. This unique identification number is used by customs officers to track and monitor shipments, verify the authenticity of importers and exporters, and ensure compliance with trade regulations. By using import and export codes (IECs), businesses can conduct trade operations efficiently and effectively while also contributing to economic growth and prosperity.

If you have any questions about import and export codes, our professional utilities team experts are always ready to provide IEC consultants and answer all your queries and concerns.

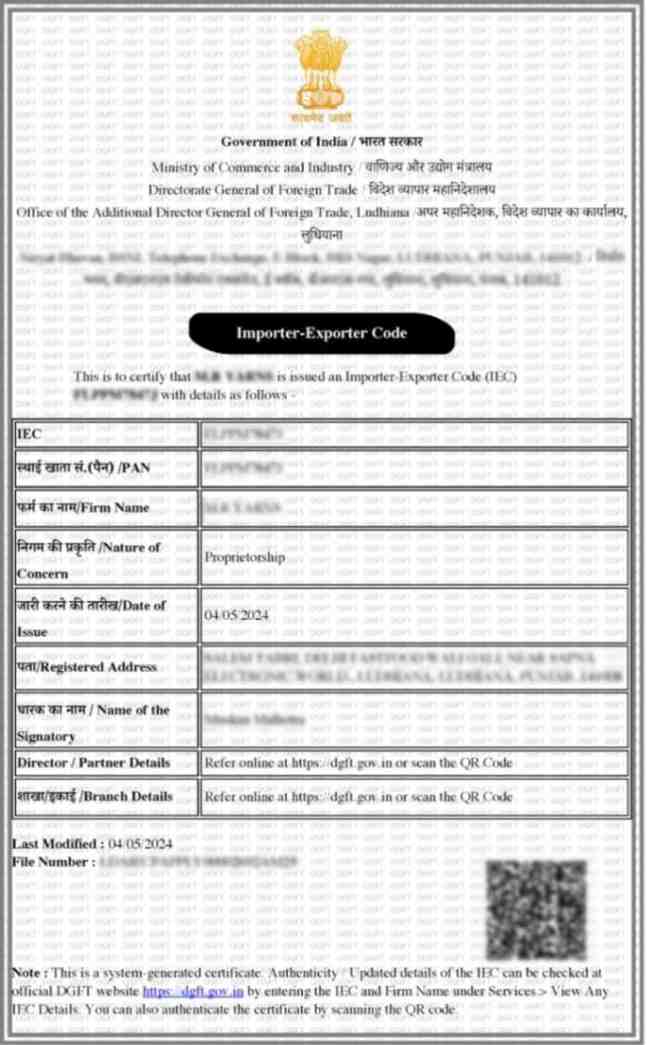

IEC Certificate for Consultant in Madhya Pradesh Sample

Table of Content

The import and export code (IEC) is a unique 10-digit code which is issued by the Directorate General of Foreign Trade (DGFT) under the Ministry of Commerce and Industry, Government of India. IEC is a mandatory document that customs authorities use to track and regulate goods entering or leaving the country. The main goal of the import and export code (IEC) is to simplify and regulate the import and export of goods and services from India. Import and Export Code registration in Madhya Pradesh is necessary for all import and export businesses. Without an IEC registration, goods cannot be imported or exported in Madhya Pradesh.

Some key aspects highlight the importance of import and export code (IEC) consultants in Madhya Pradesh:-

The process of import and export code (IEC) registration and verification in Madhya Pradesh is carried out in 5 Steps as follows:-

The Directorate General of Foreign Trade (DGFT) is an online government portal that allows you to apply for an import-export code in Madhya Pradesh. Registering here is your first initial step.

The second step is the application phase, where all your documents are organized and prepared for submission. Refer to the required documents for a better understanding.

To complete the application process, importers/exporters must fill out an online application in ANF (Aayaat Niryaat Form) 2A, submit the required document for verification, and then pay the government fee.

If your application is submitted incorrectly or incompletely, it may result in your license being canceled, so it's important to provide accurate information.

Once DGFT approves your application, you'll receive an e-IEC. After approval by the competent authority, you'll receive an email or SMS notification that your e-EIC is available on the DGFT website.

There is a list of required documents for importer and exporter code (IEC) registration in Madhya Pradesh as per follows:-

The fee structure for Import and Export Code (IEC) registration in Madhya Pradesh is mentioned below:-

| Import and Export Code Registration | Fees |

|---|---|

| Government Fees | ₹500 |

| Professional Fees | ₹999 |

| Total | ₹1,499 |

Note: The aforementioned Fees is exclusive of GST.

Let's take a look at how obtaining an import and export code (IEC) in Madhya Pradesh will help in your businesses:-

Global Business Expansion: Getting an import-export code allows your product to reach the global market, leading to business expansion. Additionally, it also opens the door to the online international marketplace.

Legalize Overseas Trade: The IEC makes it easier to trade abroad and legalizes your import and export business. The importer and exporter code (IEC) makes your trade across borders easy and legal.

Import/Export Subsidies: Exporters who promise to import goods within a specified timeframe can claim a refund for taxes imposed during export. The government will also eliminate some import duties.

Easy Registration Process: Basic documentation such as a PAN card, address proof, and bank account details are required to register for import and export code (IEC). There is no need to complete any compliance requirements like annual or return filings, as the process is hassle-free. You don’t need to travel anywhere to get an import and export code (IEC) because the entire registration process is done online.

Facilitates Electronic Fund Transfers (EFTs): Electronic fund transfer service for exporters enables them to pay the license fee online via the internet instead of visiting a bank.

Conclusion

In summary, IEC consultants in Madhya Pradesh are essential assets for businesses that are venturing into international marketplaces. For businesses that engage in importing or exporting goods and services, the Import and Export Code (IEC) is compulsory. By acquiring an IEC, businesses demonstrate their commitment to legality, transparency, and compliance, which results in easier cross-border transactions and sustainable growth in the ever-changing world of global trade. IEC Consultants assist businesses in optimizing their import and export processes, minimizing risks, ensuring compliance with relevant laws and regulations, and ultimately expanding their presence in international markets. Therefore, businesses achieve sustainable growth in the global trading scenario.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

There are necessary steps to becoming an exporter/importer in Madhya Pradesh:-

Yes, certain goods like hazardous materials, restricted items, and agricultural products require special permits or licenses for import and export in Madhya Pradesh.

The Importer Exporter Code (IEC), Bill of Entry, Bill of Lading, commercial invoices, packing lists, and certificates of origin are all commonly used documents for importing and exporting in Madhya Pradesh.

Stay updated on import/export regulations in Madhya Pradesh by regularly checking the websites of DGFT and TRIFAC, subscribing to relevant newsletters, attending seminars, and consulting with local trade associations.