In this vibrant business hub of Gurugram, which has opportunities to trade globally, businesses are left to deal with the complicated process of international commerce. In the speedy world of transactions and regulations, IEC Registration consultants come to the rescue with their indispensable expert services, providing support to companies walking along the intricate pathways of import-export operations.

The IEC is a ten-digit unique code assigned to an individual or company and is required for every import/export operation. An Import and Export Code (IEC) registration is necessary for a business to export or import goods. Trading is beneficial not only to business personnel but also to the country. The government has put trade facilitation at the forefront to decrease transaction costs and time.

If you have any questions about import and export code, our professional utilities team experts are always ready to provide IEC consultants and answer all your queries and concerns.

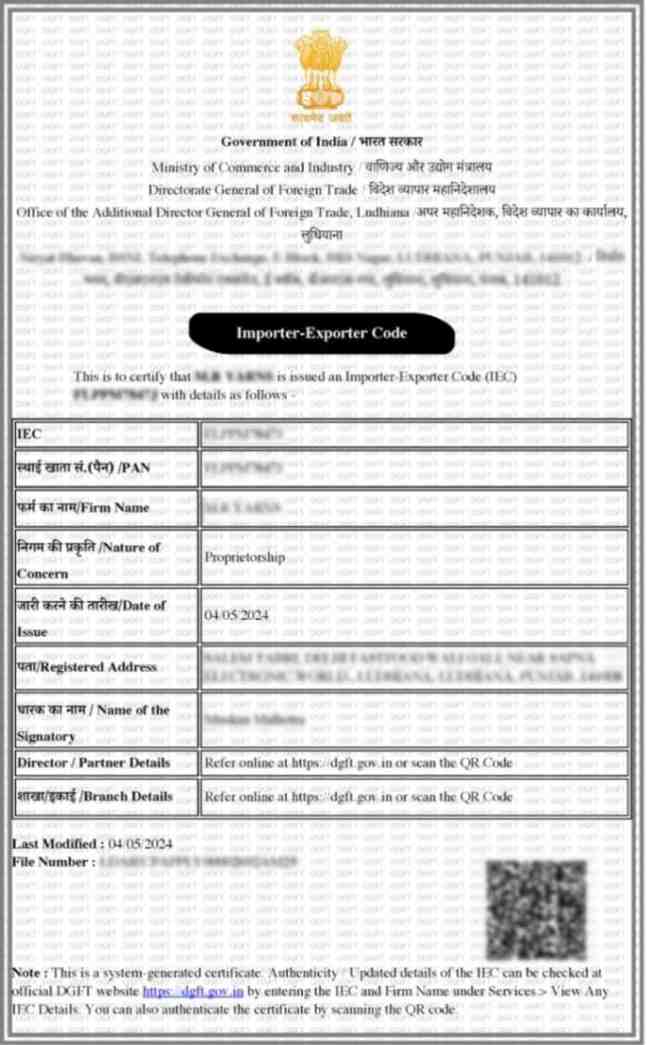

IEC Certificate for Consultant in Gurugram Sample

Table of Content

It is a 10-digit code issued by the Directorate General of Foreign Trade (DGFT), under the Ministry of Commerce and Industry, Government of India. Import and Export Code (IEC) simplifies and regulates the import and export of goods and services from India. This enables businesses to have more efficient customs clearance procedures and comply more effectively with export-import regulations.

Import and Export Code registration is important for all import and export activities in Gurugram. Goods cannot be imported or exported to Gurugram without IEC registration.

Import and Export Code (IEC) consultants play an important role in Gurugram for several reasons:

Let's see the Process for Import Export Code (IE Code) Registration in Gurugram are explained in 5 steps below:

The DGFT is the online governmental portal on which you apply for an Import-Export Code. Registering here is your first initial step.

The second step is the application phase, where all your documents are organized and prepared for submission. Refer to the required documents for a better understanding.

To complete the application process, importers/exporters must fill out an online application in ANF (Aayaat Niryaat Form) 2A, submit the required document for verification, and then pay the government fee.

In case your application is submitted with faulty information or partially completed, it can lead to your license being canceled. So, correct information should be provided.

Once DGFT approves your application, you'll receive an e-IEC. After approval by the competent authority, you'll receive an email or SMS notification that your e-EIC is available on the DGFT website.

There is a list of required documents for import and export code (IEC) registration in Gurugram:

.png)

The fee structure of import and export code (IEC) registration in Gurugram is mentioned below:

| IEC Registration | Fees |

|---|---|

| Government Fees | ₹500 |

| Professional Fees | ₹999 |

| Total | ₹1,499 |

Note: The aforementioned Fees is exclusive of GST.

There are some advantages of import and export code (IEC) registration in Gurugram which include:-

Global Business Expansion: Obtaining an import-export code allows your product to enter the global market, which leads to business expansion. Getting an Import and Export Code (IEC) in Gurugram opens the door to international online markets.

Legalize Overseas Trade: IEC facilitates foreign trade easier and makes your imports and exports business legal. The Import and Export Code (IEC) makes your trade across borders easy and legal.

Import/Export Subsidies: If an exporter promises to import the goods within a specific timeframe, they can claim a refund for taxes imposed during exporting. The government will eliminate some import duties as well.

Easy Registration Process: The registration for an import and export code requires basic documents like a PAN card, address proof and bank details, etc. The process is hassle-free and there is no need to fulfill any compliance requirements like annual filings or return filings. You can get an import and export code ( IEC) without having to go anywhere because the entire registration process is done online.

Facilitates Electronic Fund Transfers (EFTs): This new service offered to exporters enables them to pay the license fee online using the Internet instead of visiting a bank to make the payment.

Conclusion

IEC consultants shape an ever-evolving business landscape of Gurugram by bringing specialized expertise, and knowledge in local markets, and giving valuable hand-holding to companies dealing in international trade. With import-export regulations at their depth, efficient processes, and vast networks, the consultants help smooth the application process for an IEC in compliance with the regulatory requirements and smooth trade operations. An "Import and Export Code Consultant'' in Gurugram will be able to guide companies through the complications of international trade with sure-footed poise, grabbing opportunities and growing in the global market sustainably.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Gurugram IEC consultants mainly handle corporate, startup, and IT-driven export requirements, while Import Export Code Consultants in Mumbai focus more on large-scale trading, port-based exports, and manufacturing-sector compliance.

Yes, any business, large or small, and any business in Gurugram across any trade or industry that undertakes any import and export, be it an individual, proprietary, partnership, or company requires an IEC.

There are a few steps to get IEC in Gurugram which include:-

Yes, any business involved in import or export activities needs an Import and Export Code because it is mandatory for all businesses in Gurugram.