Updated on January 07, 2026 12:14:35 PM

CSR registration in Hyderabad allows NGOs to obtain CSR funds from eligible corporate companies for various CSR activities. CSR is an abbreviation for Corporate Social Responsibility, and it refers to the grant and funding process by which non-profit organizations (NGOs) can receive financial and other financial support from the business sector.

The goal of bringing all NGOs together on the MCA portal is to create an efficient CSR spending tracking system. The CSR-1 registration process is entirely online and can be completed only with Practicing CA, CS, or CMA certification. Once the CSR registration is completed and approved, Registered NGOs can apply for registration on CSR Exchange Portal after 30 days from the date of approval.

CSR-1 Form is a registration form on MCA portal that needs to be filled by the entities(Mostly NGOs) to increase their chances of receiving funds from the companies that are entitled to donate 2% of their Net profits for CSR activities.

The ministry of Corporate Affairs has made it mandatory to submit the CSR Form in order to get fundings from corporate companies. NGOs and companies are brought under one umbrella where companies can find the right organization to release funds and the NGOs can showcase their proposals in their Project reports and get CSR funds.

So, a business can engage in CSR activities independently or through a company that is registered under Section 8, registered society or public trust, or an NGO, as described above. These entities or businesses that plan to carry out CSR activities must register their businesses with the Registrar of Companies by filing the CSR-1 form electronically.

Important: In order to get funds from foreign sources, NGO need to register for FCRA certificate apart from CSR registration.

According to the Companies Act of 2013, it is mandatory for certain companies to contribute 2% of the net profit in a financial year on the CSR activities. In accordance with the Companies Act, The CSR provision applies to companies having:

The cost of filing an electronic form CSR-1 in Hyderabad is ₹2,999 only; however, the amount may differ depending on the chairperson's valid DSC. If the chairperson has a valid DSC, the filing fee will be only ₹2,999.

If the chairperson doesn't possess an approved DSC, the fee would be the amount of ₹2,000 (for DSC) + ₹2,999 (Filing Fee) equals ₹4,999 only.

| CSR Registration Fees in Hyderabad | |

|---|---|

| CSR Filing Fees with Valid DSC | ₹2,999 |

| CSR Filing fees without Valid DSC | ₹2,000(DSC) + ₹2,999(Filing) = ₹4,999 |

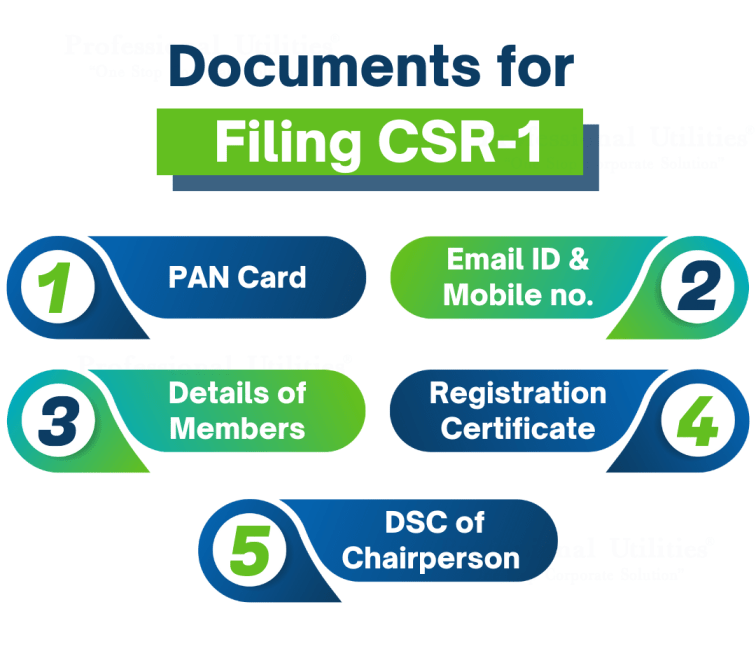

The documents that must be uploaded to CSR-1 Registration in Hyderabad are as follows:

To regulate the CSR activities by the non profit organizations, and to make sure that the usage of CSR funds are really improving the quality of lives in our country, The CSR committee has provided a full list of activities that can be performed using the CSR funds from corporate companies.

Following CSR activities are allowed for the NGOs and trusts as per the company acts, 2013

CSR-1 Registration is a mandatory compliance for all NGOs, Trusts, and Societies that wish to receive CSR funding in Bhopal. The process is carried out through the Ministry of Corporate Affairs (MCA) Portal to ensure that only verified and eligible entities are authorized to implement Corporate Social Responsibility (CSR) activities on behalf of companies.

Step 1: Documentation

Step 2: Filing on MCA Portal

Step 3: Inspection by ROC

Step 4: Approval & CSR Number

To complete CSR-1 registration in India, an NGO must follow these steps:

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

In Hyderabad, it only costs ₹2,999 to file an electronic form CSR-1. However, the amount may be different if the chairperson does not have a valid DSC. The filing fee will only be ₹2,999 if the chairperson has a valid DSC.

If the chairperson doesn't have an approved DSC, the fee would be ₹2,000 for the DSC plus ₹2,999 for the filing fee, for a total of ₹4,999.

According to the Companies Act, 2013, CSR funds can be utilized for activities specified by the CSR committee. Some of them include:

For detailed information on other activities, please refer to the complete list of CSR activities in India.

You need to file a CSR-1 form to get CSR funds from companies. Apart from that, you also need to prepare a project report that includes detailed information about the CSR activity and its impact on society. A good project report attracts good funds.

A CSR form can be filed in about two days. However, if you do not have the project report ready, it may take up to 10–15 days to write an appealing project report that boosts your chances of receiving more and more CSR funds.

To receive contributions from companies, an NGO must be registered on the MCA's CSR platform. Only NGOs that have registered with the Central Government by submitting Form CSR-1 will be eligible for CSR funding.

Yes, an NGO seeking CSR must be registered under sections 12A and 80G of the Income Tax Act of 1961.

Speak Directly to our Expert Today

Reliable

Affordable

Assured

Industries Served by

Professional Utilities

Apparels

Footwear

Furniture

Gems and Jewellery

Tourism & Hospitality

Consumer Electronics

Chemicals

Telecom

Oils & Gas

Hotel

Railways

Liquor

Health & Medical

Food Processing

Dangerous/ Haz. Goods

Tea & Coffee

Capital Goods

Recycling

Rubber

NGOs

Silk

Handloom

IT & BPM

Steel

Automobile

Tobacco

Constructions