As Gujarat's main industrial and business center, Ahmedabad presents numerous chances for CSR collaborations in fields like education, healthcare, the environment, rural development, and skill development. The Ministry of Corporate Affairs (MCA) has mandated that all CSR-eligible entities register by submitting Form CSR-1 online via the MCA portal in order to guarantee accountability and transparency.

According to the guidelines of the Companies Act of 2013, registering as a CSR organization is a must if your organization intends to receive or use CSR funding. All implementing agencies that want to conduct CSR activities on behalf of businesses, including Section 8 companies, registered public trusts, and societies, must register.

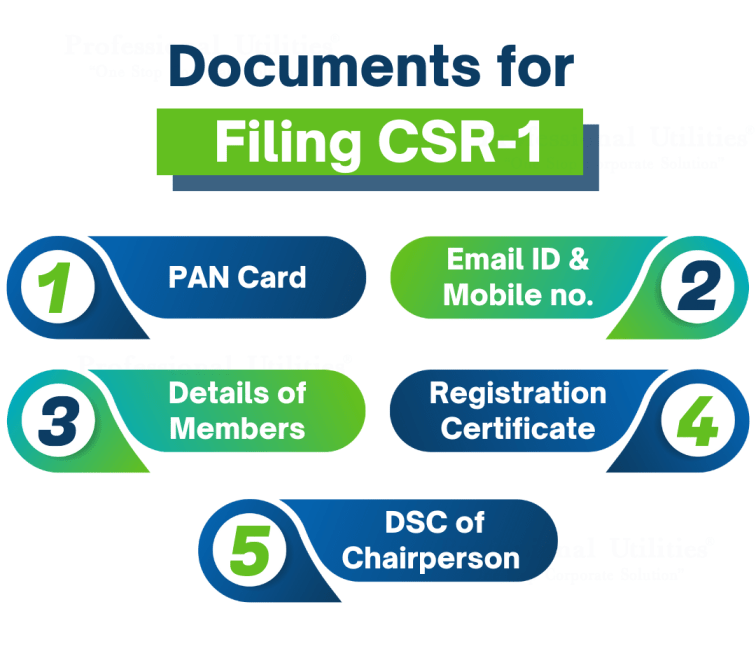

Basic documents such as the organization's PAN, registration certificate, governing body member details, and a digital signature (DSC) are required for the process. After being accepted, your organization is given a special CSR Registration Number that enables it to apply for CSR funding from businesses all over India.

To increase your credibility, open up new funding sources, and make a meaningful contribution to community development and social change, apply online for CSR registration in Ahmedabad.

The Rules state that the Board of directors of a company must ensure that the company's employees participate in CSR activities either through CSR actions or by:

So, a business can engage in CSR activities independently or through a company that is registered under Section 8, registered society or public trust, or an NGO, as described above. These entities or businesses that plan to carry out a CSR action must register their businesses with the Registrar of Companies by filing the CSR-1 form electronically.

Important: In order to get funds from foreign sources, NGO need to register for FCRA certificate apart from CSR registration.

According to the Companies Act of 2013, it is mandatory for a company to contribute 2% of the net profit in a financial year to the CSR funds. In accordance with the Companies Act, The CSR provision applies to companies having

The cost of filing an electronic form CSR-1 in Ahmedabad is ₹2,999 only; however, the amount may differ depending on the chairperson's valid DSC. If the chairperson has a valid DSC, the filing fee will be only ₹2,999.

If the chairperson doesn't possess an approved DSC, the fee would be the amount of ₹2,999 + ₹2,000 equals ₹4,999.

| CSR Filing | Fee(₹) |

|---|---|

| CSR Filing Fees with Valid DSC | ₹2,999 |

| CSR Filing Fees without Valid DSC | ₹2,999 + ₹2,000 = ₹4,999 |

The documents that must be uploaded to CSR-1 Registration in Ahmedabad are as follows:

CSR Registration is beneficial for both the registered NGOs and Corporate companies in Ahmedabad

Process of CSR-1 registration:

Documentation

Filing on MCA Portal

Inspection of the Form

Approval Letter from MCA

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

To get CSR-1 registration in Bhavnagar, eligible NGOs, trusts, or Section 8 companies must file the CSR-1 form on the MCA portal with valid registration certificates, PAN, and digital signatures. Once verified, the Ministry of Corporate Affairs issues a unique CSR registration number, enabling the organization to receive CSR funds from registered companies.

You need to file a CSR-1 form to get CSR funds from companies. Apart from that, you also need to prepare a project report that includes detailed information about the CSR activity and its impact on society. A good project report attracts good funds.

A CSR form can be filed in about two days. However, if you do not have the project report ready, it may take up to 10-15 days to write an appealing project report that boosts your chances of receiving more and more CSR funds.

To receive contributions from companies, an NGO must be registered on the MCA's CSR platform. Only NGOs who have registered with the Central Government by submitting form CSR-1 will be eligible for CSR funding.

Yes, an NGO seeking CSR must be registered under sections 12A and 80G of the Income Tax Act of 1961.

No, a freshly registered NGO cannot file CSR because a CSR-eligible entity must be at least three years old.

All the existing NGOs which are registered under Section 12A and Section 80G of Income Tax Act 1961 has to file re-registration request under both section on or before 30.06.2021. Till 30.06.2021 all the existing registrations are valid and on the basis of which you can file Form CSR-1 on MCA Portal for getting CSR Funding.