Limited Liability Partnership is a type of business registration which is most suitable for small and medium enterprises. LLP Registration Online in Chennai is the best choice for the small scale business owners and service providers planning to start a company in partnership. Go through the page to read about LLP Registration Online in Chennai, Process, Documents required, Govt and Professional Fees, Time required, features.

LLP offers the benefits of both a partnership and a limited liability company, making it an attractive option for those seeking a flexible yet protected business structure. If you're interested in understanding the process of LLP registration in Chennai, you've come to the right place.

Consult with Professional Utilities to get your LLP Registration online in Chennai at just ₹8,499 in 7-10 working days.

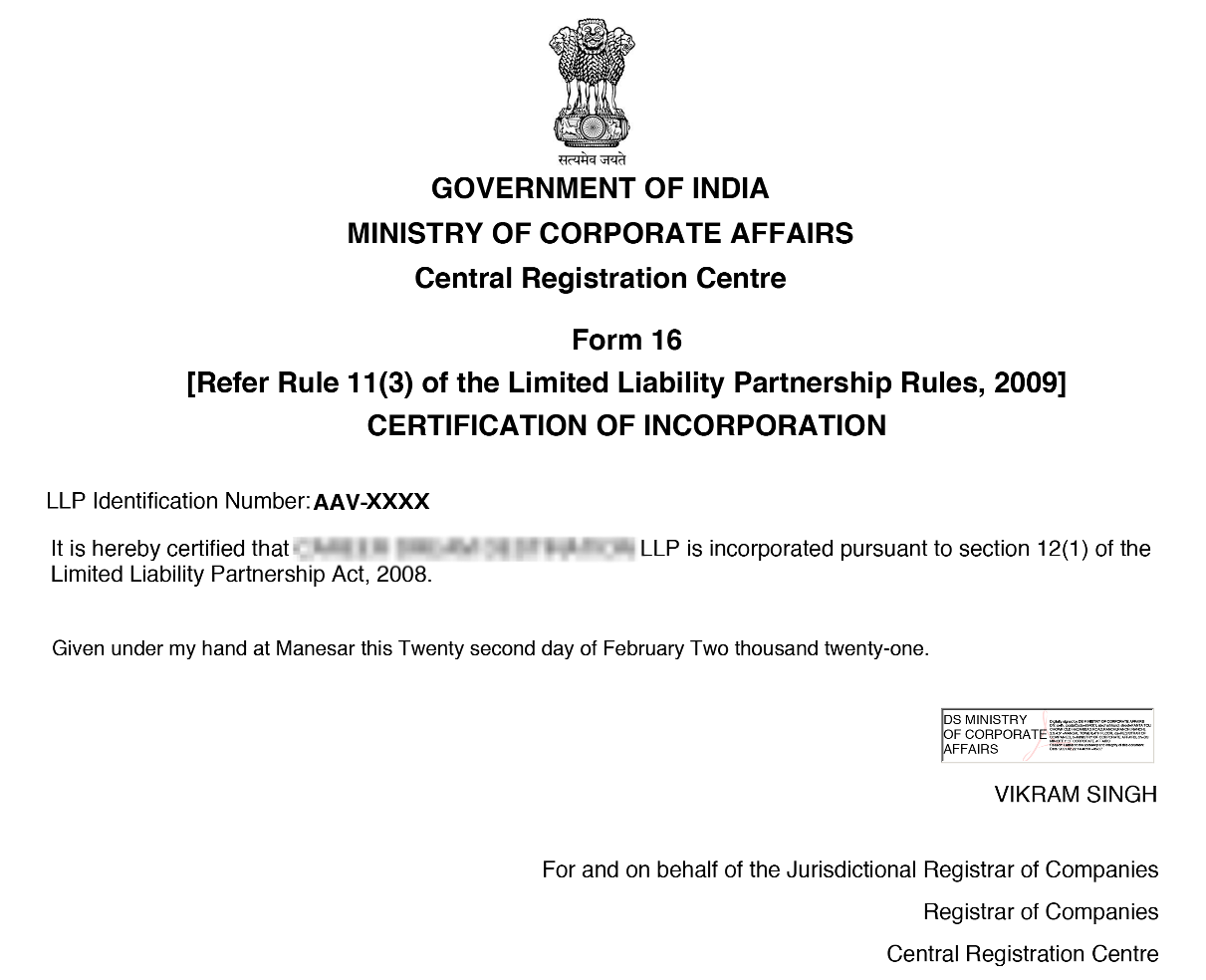

LLP Registration [Sample]

Table of Content

LLP is a form of a partnership registered under the Limited Liability Partnership Act, 2008, where liabilities of all the partners are limited to the extent of contribution bought by them. It helps owners limit their liabilities while enjoying the advantages of a limited company which is an edge over a traditional partnership firm.

No partner is liable for unauthorized actions of other partners; thus, individual partners can safeguard them from joint liability arising from the misconduct of other partners. Professionals, micro and small businesses mostly prefer LLP as an organization.

Minimum two partners are required to incorporate an LLP. However, there is no upper limit on the maximum number of partners of an LLP. There should be a minimum of two designated partners who shall be individuals, and at least one of them should be residents in India.

The LLP agreement governs the rights and duties of designated partners. They are directly responsible for complying with all the provisions of the LLP Act, 2008 and provisions specified in the LLP agreement.

| LLP Registration Online in Chennai | Details |

|---|---|

| Cost of LLP Registration Online in Chennai | ₹8,499 |

| Time Required to Register LLP in Chennai | 7-10 days |

| Documents Required For LLP Registration Online in Chennai |

|

| Steps To Register LLP in Chennai |

|

| Steps after Company is Registered |

|

| Mode of Application for LLP Registration | Online Application |

Registering a Limited Liability Partnership (LLP) in Chennai offers several advantages, making it a popular choice for businesses seeking flexibility, legal protection, and cost-efficiency. Here are the key benefits of LLP registration in Chennai:

Below are the essential requirements to facilitate your Limited Liability Partnership (LLP) registration process in Chennai. Please ensure to verify the specified details:

To successfully register an LLP in Chennai, you’ll need to submit personal and business documents for verification by the Ministry of Corporate Affairs. Below is the complete list of required documents:

Following are the documents you’ll receive after registering an LLP in Chennai:

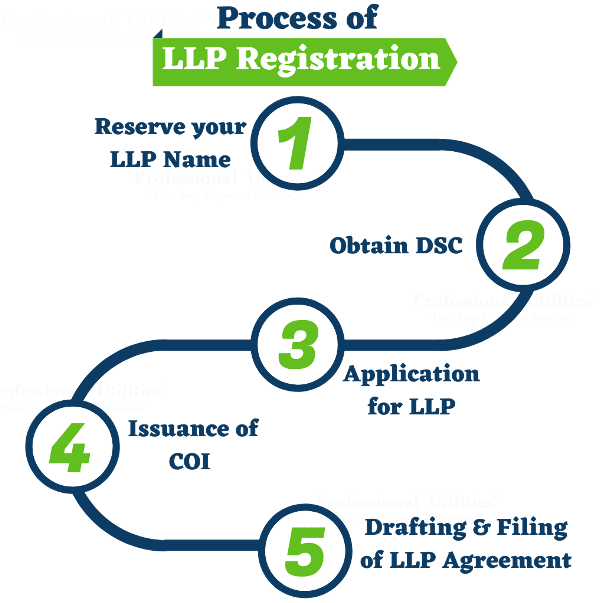

Starting a Limited Liability Partnership (LLP) in Chennai is a seamless, fully online process governed by the Ministry of Corporate Affairs (MCA). Below is a step-by-step overview to guide you through the registration process:

The total cost of LLP Registration in Chennai, is ₹8,499 Only including government fee and professional fees. The LLP formation process takes around 10 working days subject to document verification by MCA.

| Steps | Fees Rs. |

|---|---|

| Digital Signature Certificate of 2 Partners | ₹3,000 |

| Govt Fee | ₹1,500 |

| Professional Fee | ₹3,999 |

| Total Cost | ₹8,499 Only |

Note: The aforementioned Fees is exclusive of GST.

The total time required for LLP registration in Chennai is around 7-10 working days which is subject to documents verification by MCA.

LLP registration in Chennai is a crucial step for entrepreneurs and professionals looking to establish a business entity that combines the benefits of a partnership with limited liability protection. Throughout this comprehensive guide, we have explored the intricacies of LLP registration, from its definition and advantages to the eligibility criteria and the step-by-step registration process.

By choosing to register your business as an LLP, you can enjoy the flexibility of a partnership while safeguarding your personal assets. The limited liability protection offered by an LLP ensures that each partner's liability is limited to their agreed contribution, shielding them from the financial risks associated with the business.

Looking for LLP registration in Chennai, contact our team at Professional Utilities and get LLP incorporated at Rs 8,499 within 7-10 days.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

The registration fee for LLP companies in Chennai is Rs 8,499 which includes DSC for minimum 2 members, 1 Lakh Authorised capital, Government Stamp duty as well as Professional Fees of Professional Utilities.

To get your LLP Company registration in Chennai, you need to submit all the valid documents, pay government and professional fees, and complete verification through the MCA portal.

The usual time required for LLP company Registration in Chennai is around 7–10 working days, subject to document validation from the concerned ministry.

The LLP registration process in Chennai includes 5 steps which are: obtaining DSC, DPIN, LLP Name Approval, LLP Incorporation Certificate, and drafting the LLP Agreement.

Speak Directly to our Expert Today

Reliable

Affordable

Assured