Sometimes navigating and uploading a TDS return on the TRACES portal can be difficult for some of the taxpayers. Complying with the data procedure too has been found tedious by many. Therefore, to ease the process the income tax department has provided for uploading the return on their own website, which we cover in detail in this article.

Prerequisites for uploading TDS returns

Before you start uploading the return, you must ensure the following.

- You must hold a valid TAN and it should be registered for e-filing

- Your TDS statements should be prepared using Return Preparation Utility (RPU) and validated using File Validation Utility (FVU)

- You should have a valid Digital Signature Certificate (DSC) registration for e-filing if you wish to upload using DSC

- The principal contact’s bank account or demat account details should be provided or the principal contact’s PAN should be linked with Aadhar if you wish to upload using EVC

How to upload TDS statements on income tax portal

Here is a step-by-step guide on uploading TDS statements on the income tax website:

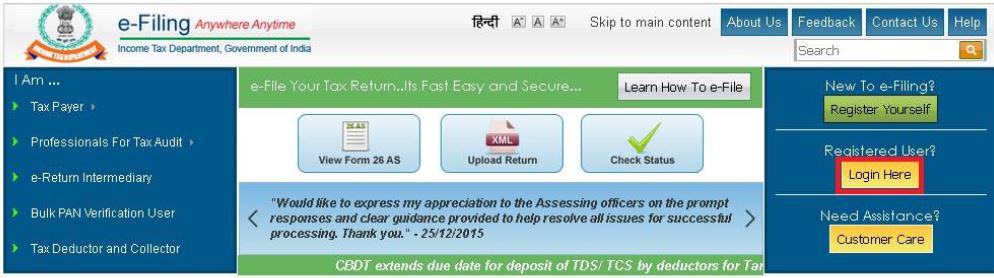

Step 1: Go to https://www.incometax.gov.in/iec/foportal/ and click on ‘Login Here’.

Step 2: Enter your login credentials and click on ‘Login’. Your user ID will be your TAN.

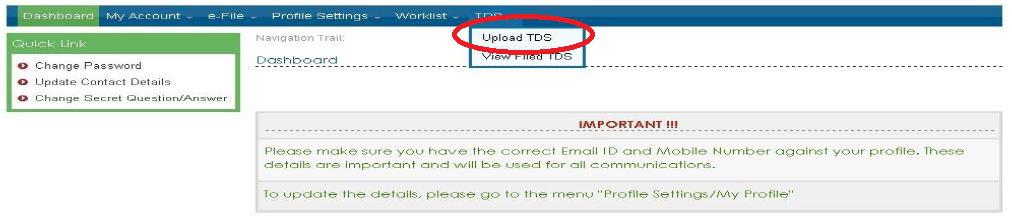

Step 3: Once you’ve logged in, click on the ‘Upload TDS’ option under the TDS tab.

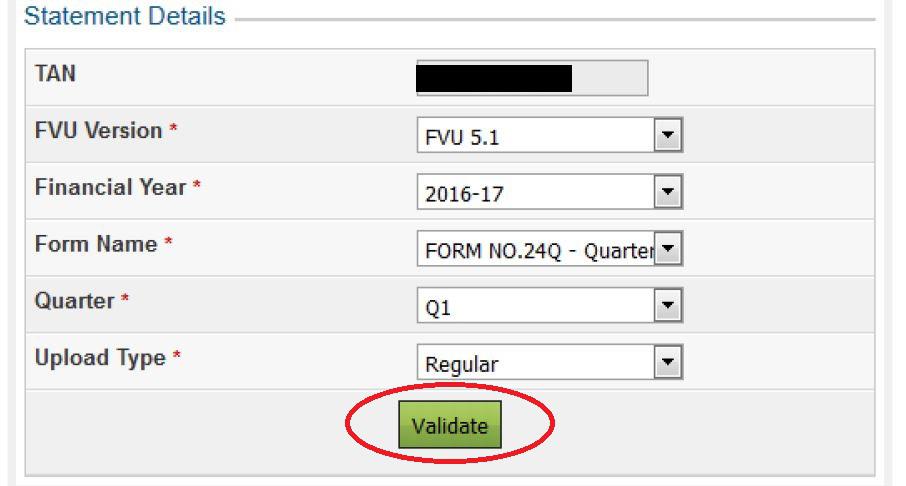

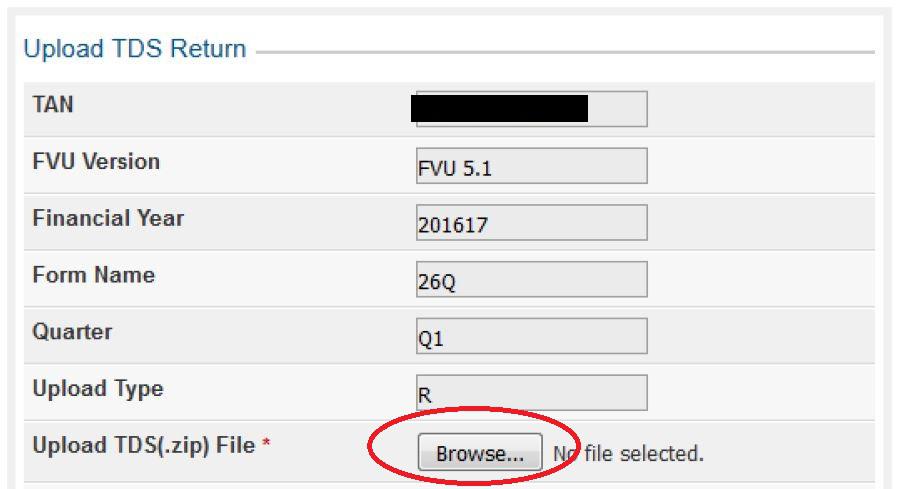

Step 4: You will be provided with a form where you will need to select the correct details. Once the details are selected, click on Validate.

Note that TDS statements can be uploaded only from FY 2010-11 and only regular statements can be uploaded on the income tax website.

Step 5: The returns can be validated through the following modes:

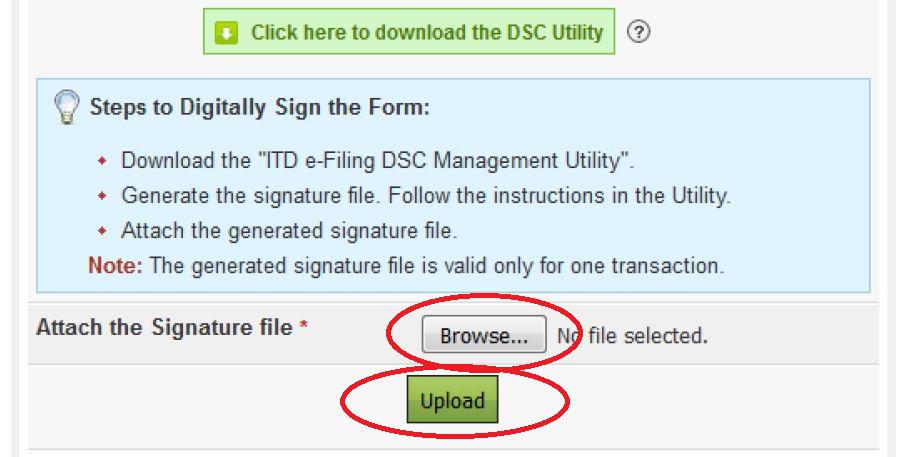

Step 5a: Validate using DSC or Digital Signature Certificate.

The TDS statements can be uploaded using DSC. To upload using DSC, first upload the TDS zip file and also attach the digital signature file. Then, click on Upload.

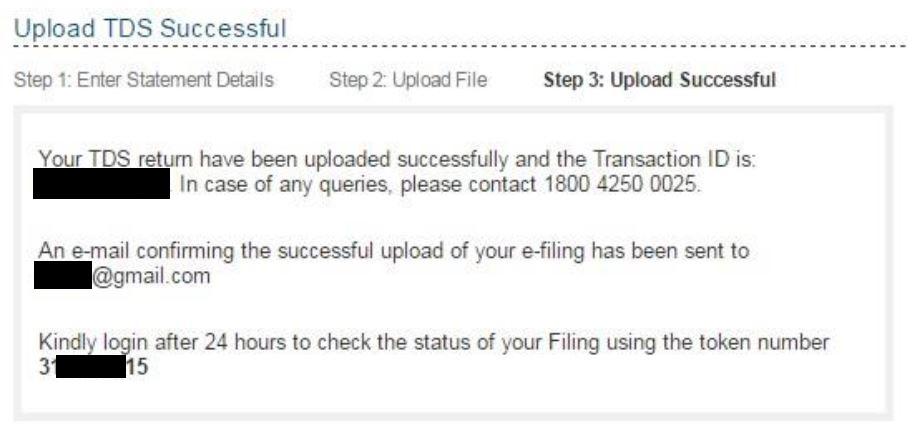

Once the TDS statement is uploaded, a success message will appear on the screen and a confirmation mail will be sent to your registered email ID.

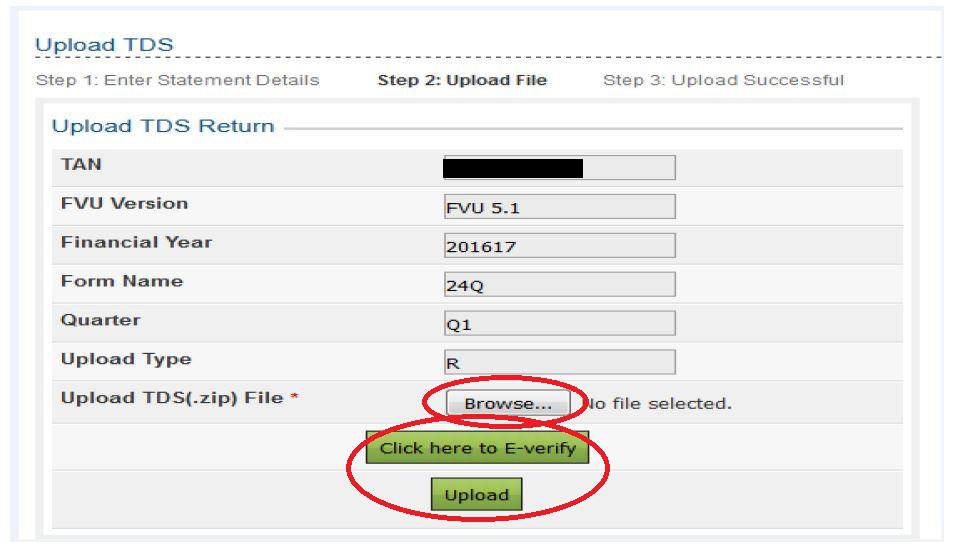

Step 5b: Validate using EVC or Electronic Verification Code.

After step 4, if you haven’t generated a DSC, you will be able to validate the TDS statements using an electronic verification code (EVC). Upload the TDS zip file and click on ‘Click here to E-verify’.

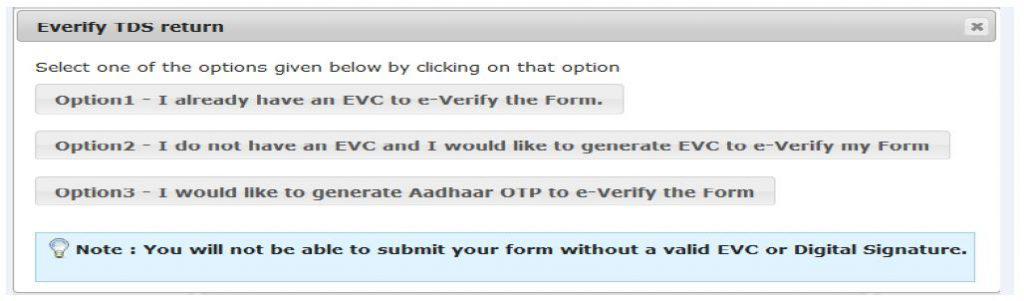

The next screen will give you the option to use an EVC already generated or generate a new EVC.

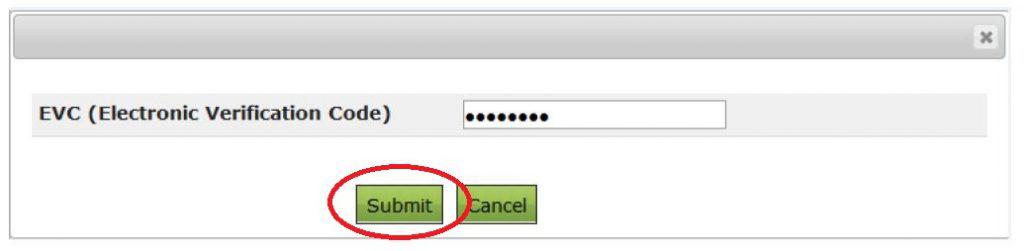

Select the relevant option, enter the EVC and click on ‘Submit’.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

.svg)