Startup India Registration in Chandigarh is a key opportunity for new businesses to grow with strong support from the Government of India. Launched to promote innovation and entrepreneurship, this initiative supports startups by easing compliance requirements and offering valuable benefits through DPIIT recognition.

Startups registered under this scheme in Chandigarh can enjoy tax exemptions for up to three years, easier access to loans, and quicker approvals. They are also eligible for funding through programs like the Startup India Seed Fund and SIDBI’s Fund of Funds. These benefits are designed to help young businesses manage early challenges and scale with confidence.

To make use of these advantages, eligible businesses must register on the Startup India portal and apply for DPIIT recognition in Chandigarh. Once approved, startups can tap into government support, grow sustainably, and contribute to job creation in the region. This registration is an important step toward building a strong foundation for long-term success.

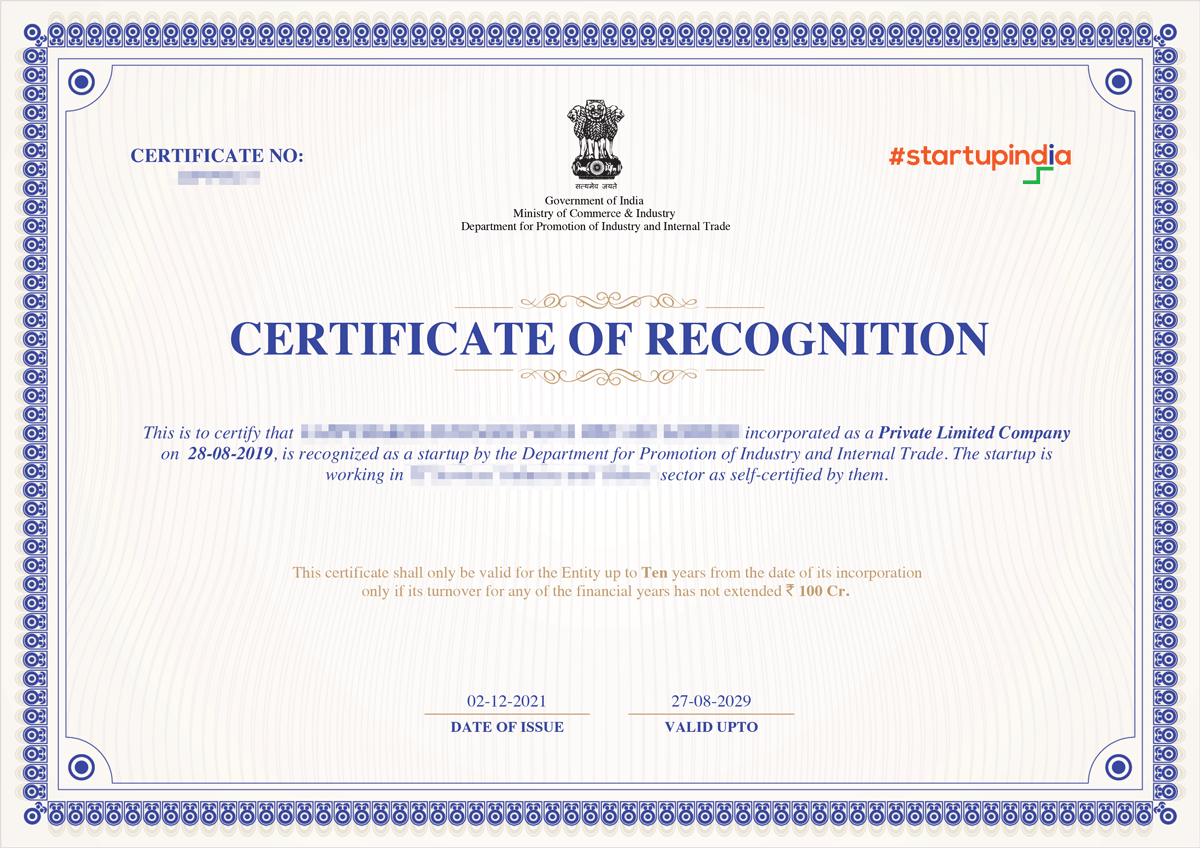

Startup India DPIIT Sample Report

Table of Content

Startup India Registration in Chandigarh is a government-backed initiative that supports the growth of new and innovative businesses. With DPIIT recognition, startups can access several benefits, including tax exemptions, easier funding options, faster approvals, and assistance from incubators. The program is designed to reduce early-stage challenges and help entrepreneurs build a strong foundation for their ventures. Eligible businesses must register on the Startup India portal and apply for DPIIT recognition specific to Chandigarh. Once approved, they can take advantage of the scheme’s offerings and grow their business with better resources, support, and opportunities for long-term success.

Startups in Chandigarh that are recognized by DPIIT can enjoy several benefits designed to support their early growth:

To register under the Startup India initiative in Chandigarh and get DPIIT recognition, businesses must meet specific eligibility criteria set by the Government of India. These include:

The following documents need to be submitted by the entities for recognition of Startup India by DPIIT.

Getting your business registered under the Startup India initiative in Chandigarh is a smooth and straightforward process with Professional Utilities. Here’s how it works:

Start by submitting all necessary business information and documents needed for DPIIT registration through the Startup India portal.

Once your documents are received, our experts will prepare and draft the required submissions for your Startup India application.

After completing your profile on the Startup India portal, we will file the DPIIT recognition application on your behalf.

DPIIT will review your application based on its guidelines and evaluate whether your business meets the criteria for recognition.

If all conditions are met, DPIIT will grant recognition within 20–25 working days. Applications not meeting the eligibility norms may be rejected.

Registering your business under the Startup India initiative in Chandigarh is easy and affordable with Professional Utilities. The professional fee for DPIIT Startup India Registration in Chandigarh is ₹4,999, which covers end-to-end assistance from document collection to final approval.

| Particulars | Fees |

|---|---|

| Professional Charges | ₹4,999 |

| Time Taken for Registration | 7-10 days |

Conclusion

Startup India Registration in Chandigarh offers a valuable chance for new businesses to grow with reliable support from the government. With DPIIT recognition, startups can enjoy tax benefits, easy access to funding, and fewer regulatory hurdles. This scheme encourages innovation and makes it easier to enter government projects. At Professional Utilities, we manage the entire process from document collection to final approval, ensuring a smooth and timely experience. If you are looking to build a strong foundation for your startup, apply today and take the first step toward long-term success under the Startup India initiative.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions (FAQs)

DPIIT recognition is granted to eligible startups under the Startup India scheme. It helps startups in Chandigarh access tax exemptions, funding, and other government benefits to support their early growth.

To be eligible, a startup must be less than 10 years old, have a turnover under ₹100 crore, be registered as a Pvt. Ltd., OPC, LLP, or partnership firm, and work on an innovative product or service.

Startups get tax exemptions, self-certification under labor and environmental laws, access to government tenders, no EMD requirement, patent fee rebates, fast-track IP processing, and funding support.

You need an authorization letter, PAN, incorporation certificate, directors’ ID proofs, photographs, business profile, product visuals, and supporting documents like GST, IPR, or MSME registrations if available.

Startups may access funding from the Startup India Seed Fund Scheme and SIDBI’s Fund of Funds, aimed at supporting early-stage ventures with growth potential.

Only new entities that are not formed by splitting or restructuring an existing business are eligible. The business must also meet other eligibility criteria.Scheme and SIDBI’s Fund of Funds, which support early-stage development and business expansion.

Yes, DPIIT-recognized startups get support from government-appointed facilitators for patents and trademarks. Their service charges are fully paid by the government.

You can apply online through the Startup India portal. Professional Utilities can assist you with the complete process, including documentation, application filing, and follow-up until approval.