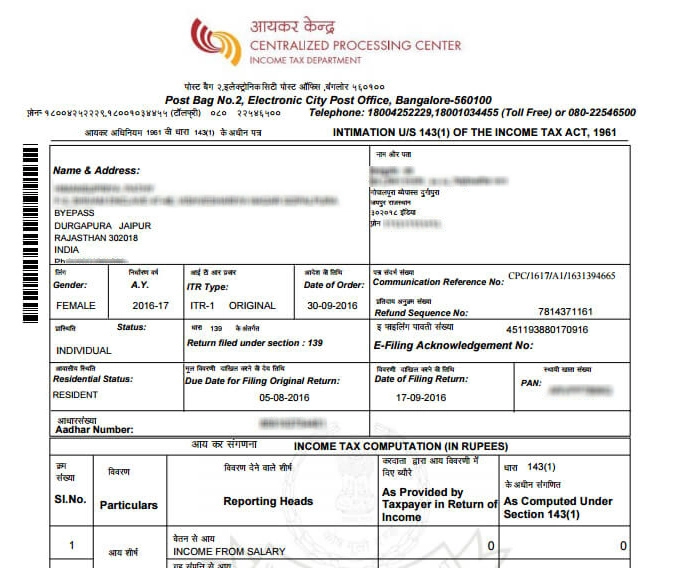

Intimation u/s 143(1) is a summary of the details which you have submitted to the tax department and the details which department has considered while processing your return. Basically, the intimation u/s 143(1) contains the following information:

Basically, when a return is submitted to Income Tax Department, the department applies the following computerized checks as a part of its review procedure:

Arithmetical errors in the return.

After these checks, have been applied, then Income Tax Department Issues Intimation u/s 143(1) in the cases where there’s:

However, practically you can still receive it, even if your case does not fall in the above mentioned three criteria. It is seen practically that Intimation u/s 143(1) is sent to all taxpayers by the Income Tax Department.

Intimation u/s 143(1) can be issued only upto 1 year from the end of the financial year in which the return is filed, and not after that.

For example,

1. If you have filed your return for the year 2018-19 on 21.07.2019, then in that case, the financial year-end will be on 31st March 2020 and intimation can be issued till 1 year i.e. intimation u/s 143(1) can be issued for the FY 2018-19 only up to 31st March 2021.

2. Lastly, do not ignore this notice as you’re required to submit your response within 30 days of receipt of such notice, in case any action is required.

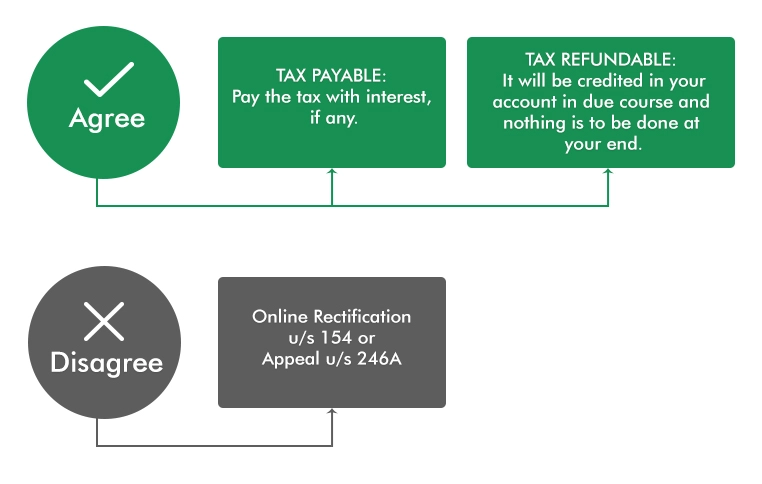

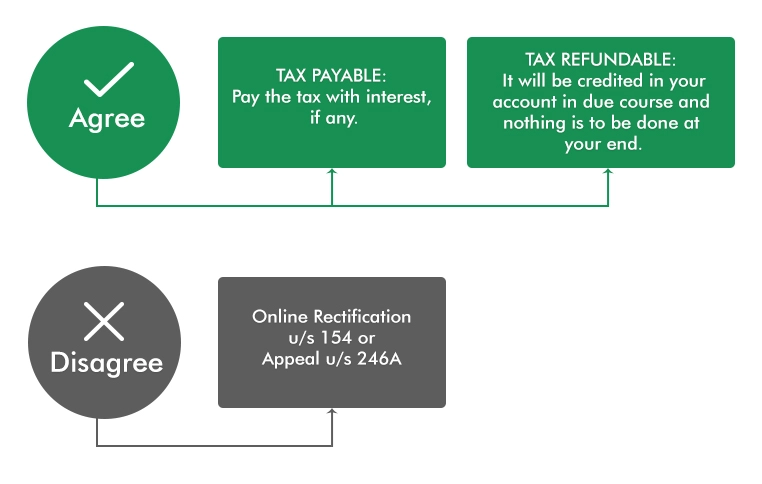

On receiving the intimation u/s 143(1), there’ll be two cases, either you’ll agree with the computation done by the department or you’ll not.

In case you do not receive any intimation till the expiry of one year from the end of the financial year in which you filed your return, your ITR-V acknowledgement will be treated as your intimation. However, it is still advisable to check online whether your ITR has been processed by the Income Tax Department. This becomes especially important when reviewing benefits such as the Section 87A Rebate under Income Tax Act.

These intimations are auto-generated which are sent to the Email address provided by you at the time of filing income tax returns online / mail id given at the time of registration on income tax website. The sender of these mails is Central Processing Centre (CPC) with the sender id being [email protected] as the returns are processed at CPC only.

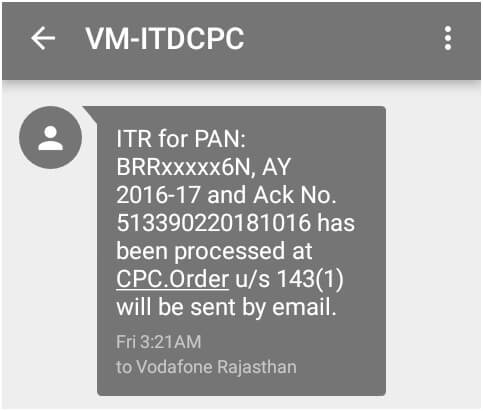

As technology is growing, so is the Income Tax Department. Now with the sending of Intimation u/s 143(1), a text message is also sent on the registered mobile number.

The attachment received is a password protected file which is your PAN number in lowercase followed by your date of birth in DDMMYYYY format.

For example,

Suppose your PAN is AAGRK5803P and your birth date is 2nd November, 1982, then the password to open your online intimation u/s 143(1) shall be “aagrk5803p02111982”

You can contact the Income Tax Helpline/Toll-Free Number of CPC Bangalore at 1800 103 4455 or 91-80-46605200 for Income tax queries. You can easily contact them with the help of the Document Identification Number mentioned on the intimation issued to you.

If you have not received your intimation on the registered mail Id or in case you are unable to find that mail again you can get your intimation u/s 143(1) again by following any of these methods:

Let us understand both the processes one by one.

By downloading it from Income Tax India Official website

This facility has been newly introduced by the income tax department under which you can download the intimation for the latest years by making a successful login to your income tax India efiling account. To download the intimation

Make login to income tax India efiling

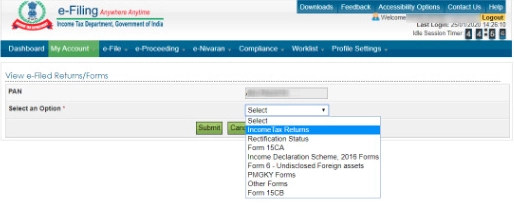

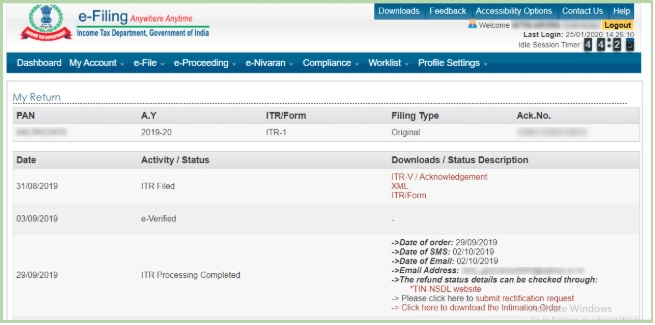

Click on View Returns and Forms

Select income tax returns

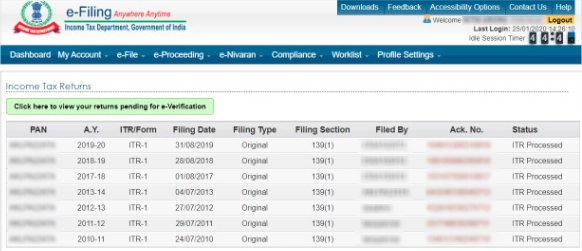

Click on the acknowledgment number for which you want to get the information and for which the ITR has been processed

Click on intimation and the intimation in pdf attachment will download.

All the intimations and communications by the income tax department are served by Email and many of the time we miss checking our mailbox or accidently loose them. So, to get the copy of intimation again you can make an online request for reissue of the intimation u/s 143(1)/154. Just follow these steps :

Note: Click on the below steps to see how your screen will look like while following the process.

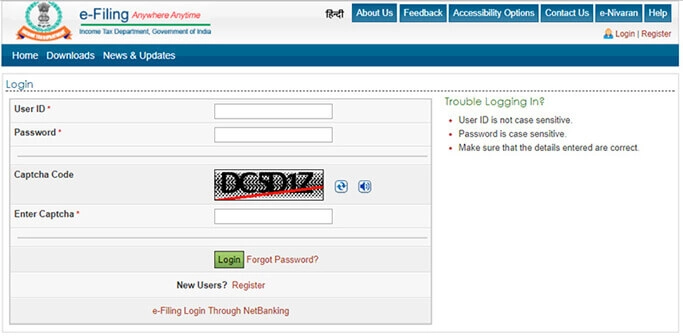

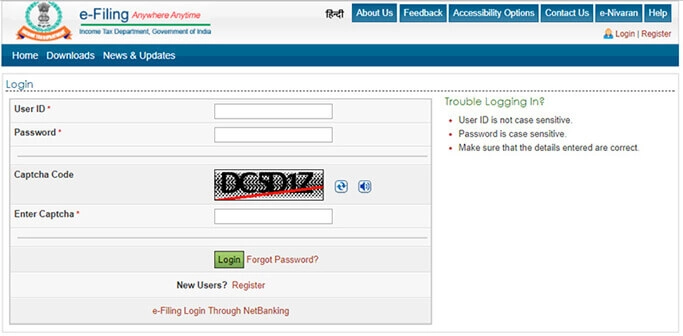

Login to e-Filing website of the IT Department using your User ID, Password, and Captcha.

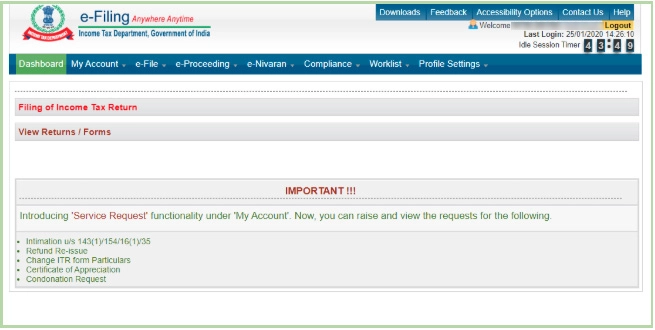

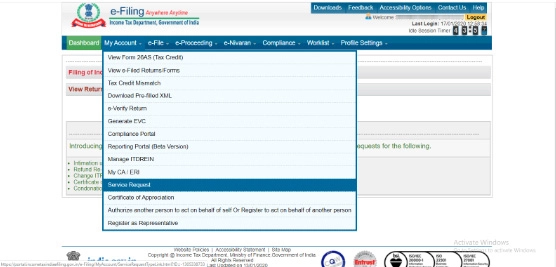

Go to My Account tab and click on "Service Request" option from the drop-down menu on your dashboard.

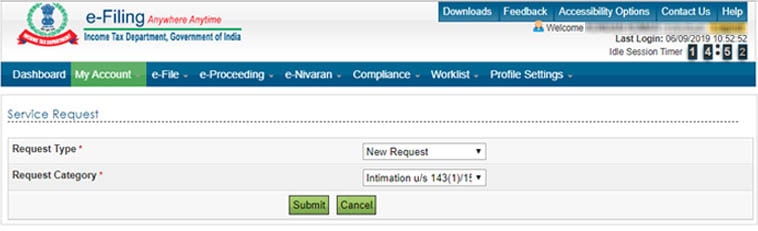

After selecting the Service request option , a new screen would appear asking the request type asking the request type - Select as New . After that select the Request category from the dropdown as intimation u/s 143(1), 154. Then click on submit.

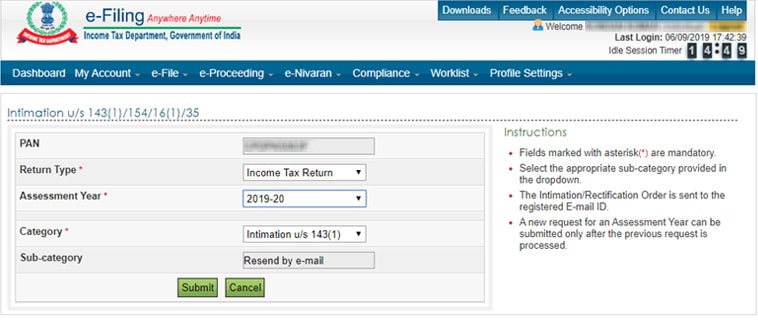

After that you have to fill in the required fields as displayed below depending upon your requirement and click on submit.

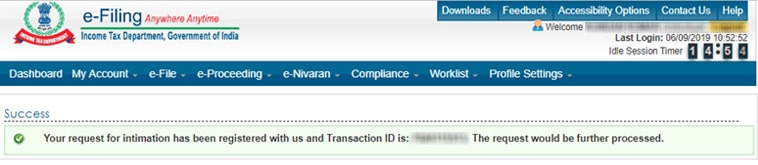

After submitting the above required options and details , the intimation would be resend to your email in some days. So, keep checking your inbox.

To sum up, Intimation u/s 143(1) is a computer-generated notice which contains the final amount of tax payable or refunds to be granted, along with interest.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam