GST Registration is the procedure of enrolling under the Goods and Service Tax system. It is mandatory for all businesses to get GST Registration falling under certain criteria. Businesses get many benefits after Registration under GST like an increase in transparency, eliminating cascading effects, reduction in cost, increase in logistics efficiency, and many others. By reading through this page get full information about the GST Registration.

Professional Utilities helps taxpayers of any category to get the GST Registration.

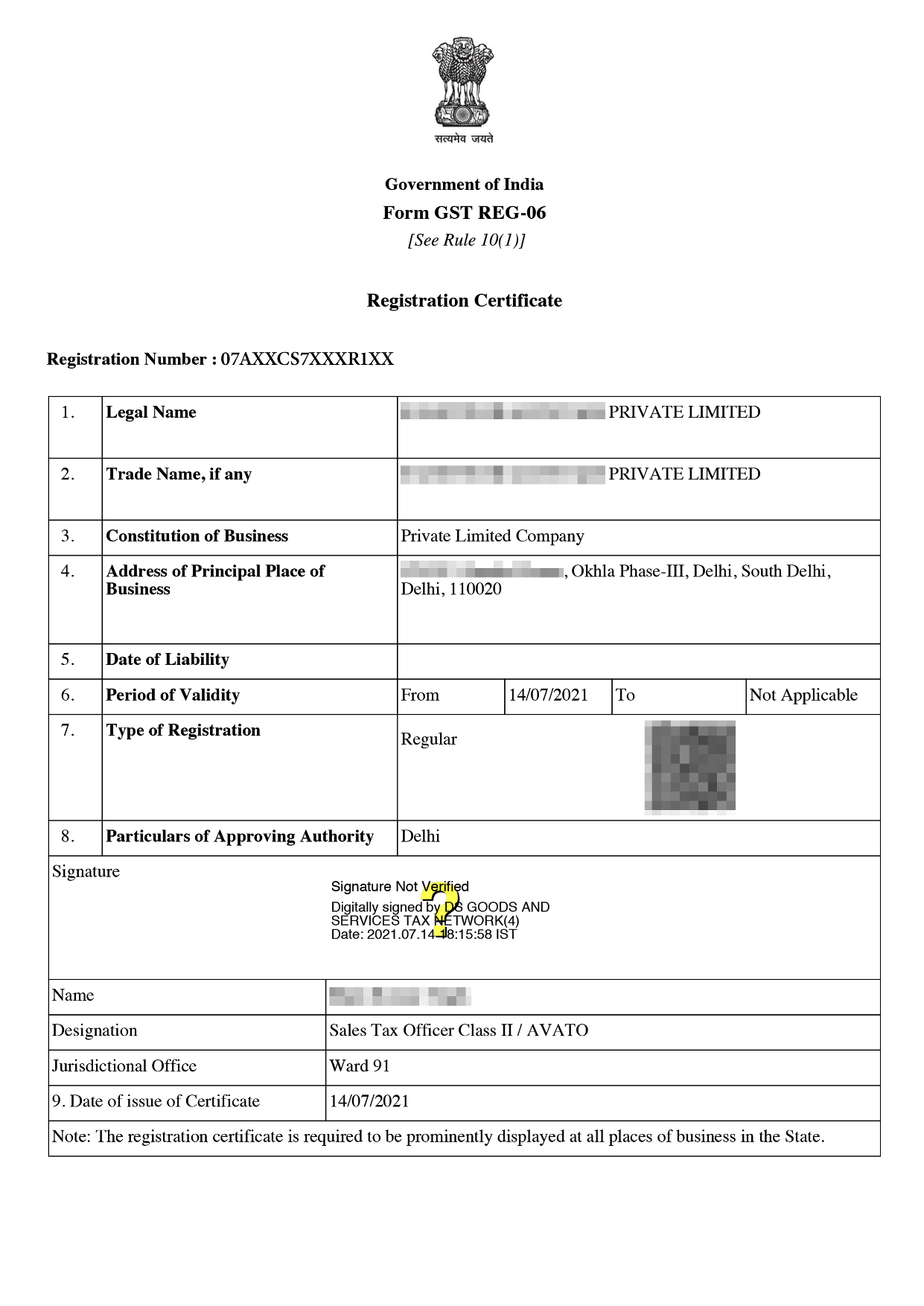

GST Registration Certificate Sample

All businesses or any person involved in the supply of the goods are required to get GST Registration. They have turnover of more than 40 lakhs and 10 lakhs in special states such as Uttarakhand, J&K, Himachal Pradesh, and North-eastern states in a financial year. Goods & Service Tax Registration Certificate for goods is mandatory for all normal Taxpayers.

All Businesses and Individuals whose turnover is more than 40 Lakhs providing goods and 20 Lakhs in providing services. Turnover exceeds 10 lakhs in special category states. There are certain businesses that must register regardless of the turnover of the company as mentioned below -

The list of following documents are needed for registering under GST for goods -

When total turnover exceeds the prescribed limit then it is mandatory for the firm to get registration.

Professional Utilities helps to get GST Registration at Rs. /-.

Note: The aformentioned Fees is exclusive of GST.

The GST registration for Goods is obtain by following the easy Steps which is described below.-

There are many benefits due to which firm should get GST Registration -

Legal strength - Getting GST Registration helps in getting legal standing in the court in case if anyone sues. GST Registration can be useful in the court.

Hurdles are avoided - It would be difficult to run a business without GST Registration. Whole supply chain from customer to retailer to wholesaler to manufacturer operated around the GST Regime.

Penalties are avoided - If businesses become eligible for GST Registration and they fail to do so. They face many penalties and also lose trust in the government.

Credibility - Getting GST Registration increases trustworthiness of the business as supplier or customer.

Benefit of claiming Input Tax - Firm can claim the Input Tax Credit which in turn decreases the cost of the product.

Conclusion

GST Registration is the process that involves registration of the business under GST Regime. There are many benefits of the GST Registration like increase in transparency, simpler taxation process, decrease in cost, government income increases and many others. The GST registration process involves filling of application forms, uploading required documents and verification. After this, getting a GST Registration Certificate and GST number.

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

Transparent Refund

Assurance

"Explore how Professional Utilities have helped businesses reach new heights as their trusted partner."

Testimonials

It was a great experience working with Professional Utilities. They have provided the smoothly. It shows the amount of confidence they are having in their field of work.

Atish Singh

It was professional and friendly experience quick response and remarkable assistance. I loved PU service for section 8 company registration for our Vidyadhare Foundation.

Ravi Kumar

I needed a material safety data sheet for my product and they got it delivered in just 3 days. I am very happy with their professional and timely service. Trust me you can count on them.

Ananya Sharma

Great & helpful support by everyone. I got response & support whenever I called to your system. Heartly thanx for Great & Super Service. Have a Great & Bright future of team & your company.

Prashant Agawekar

Thank you so much Professional Utilities team for their wonderful help. I really appreciate your efforts in getting start business. Pvt Ltd company registration was smooth yet quick.

Abhishek Kumar

I applied for Drug licence and company registration and their follow-up for work and regular updates helped me a lot. They are happily available for any kind of business consultancy.

Vidushi Saini

Great experience went to get my ITR done, process was quite convenient and fast. Had a few queries, am happy about the fact those people explained me all things I wanted to know.

Taniya Garyali

Great services provided by Professional Utilities. They are best in this industry and the best part is their prices are so affordable. Kudos to you. Now you guys are my full-time consultant.

Aftab Alam

Frequently Asked Questions

12% is the rate on goods. The rate comprises SGST at 6% and CGST at 6%.

Companies or business owners who have a taxable turnover of more than 40 lakhs are required to register as regular taxable persons for Normal States under the GST registration limits. On the other hand, those with a taxable turnover of under 20 lakhs must register as particular taxable persons or Special States.

Simpler Taxation system. You will be able to spend less time on tax compliances after you register for GST. GST unifies the different tax compliances under excise, service tax, CST, VAT, etc., making the process of paying taxes considerably easier and quicker.

The rule for suppliers of goods exempts them from registering and paying GST if their total sales stay under ₹40 lakh.

Speak Directly to our Expert Today

Reliable

Affordable

Assured