Highlights of FM Speech 20 Lakh Crore Stimulus Detail Package Announced

The PM on 12 May 2020 announced that the FM, over a period of a few days this week, will let us know the stimulus package, which will be Rs 20 Lakh Crore. Following are the MSME FM speech highlights announced today by Finance Minister Nirmala Sitharaman.

The FM began the speech by saying that PM Modi has laid out a vision after wide and deep consultations with several sections of society. These discussions were held at various levels, and all inputs obtained are duly considered and form part of the package. The MSME financial stimulus India is designed to serve growth and build a self-reliant India on five pillars.

The Prime Minister in his speech yesterday outlined his vision for Aatmanirbhar Bharat and exhorted Indians to become vocal for our local products. Atma-nirbhar (self-reliant) India does not mean India is to be an isolationist country. The government has also introduced measures like TDS reduction MSME to support small businesses and improve liquidity.

5-Pillars for self reliant with 20 Lakh Crore Package in 2020 1. Quantum jump in Economy 2. Modern Infrastructure 3. Tech driven Systems. 4. Vibrant Demography 5. Demand

The Government under PM Modi has been a listening and responsive government; hence, it is fitting to recall some reforms which have been undertaken since 2014, including initiatives like MSME tax filing extension to ease compliance for small businesses.

The Direct Benefit Transfer, Microinsurance schemes, PM Awas Yojana, PM Ujjwala Yojana, Swachh Bharat, and Ayushman Bharat were all transformative reforms which have benefited the poor in a big way, along with measures like MSME audit date extended to ease compliance for small businesses.

Today, the #EconomicPackage has 16 different measures

6 of which deal with MSMEs

2 relating to EPF

2 relating to NBFCs, housing finance corporations and MFIs

1 on discoms

1 on contractors

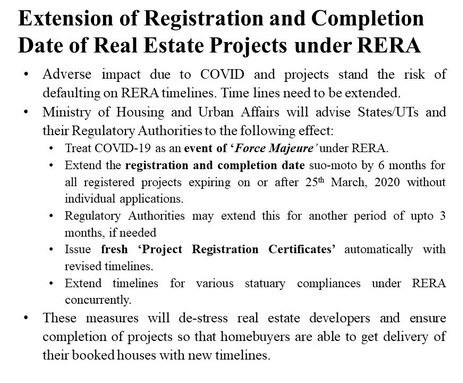

1 on real estate

3 on tax measures

Following are the Announcements

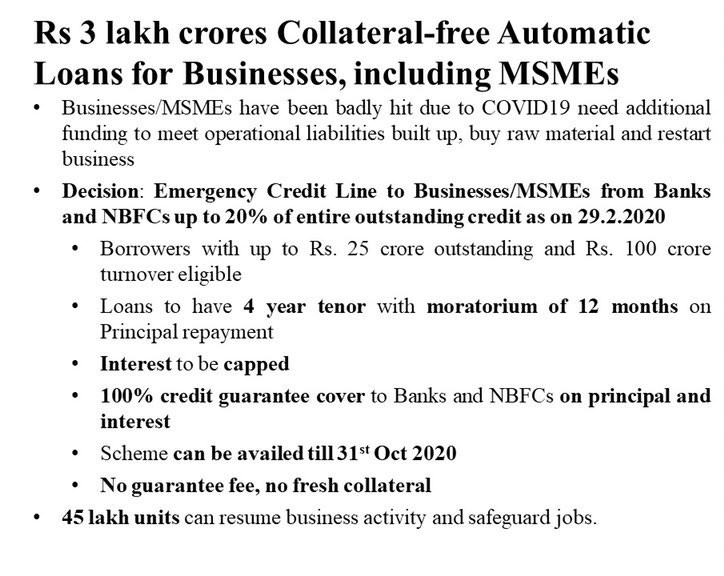

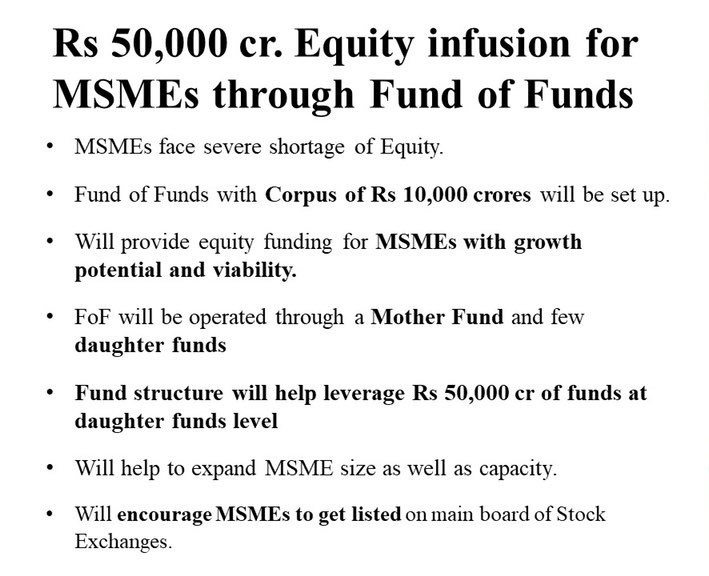

1) Government announces Rs 3 lakh crores Collateral-free Automatic Loans for Businesses, including MSMEs.

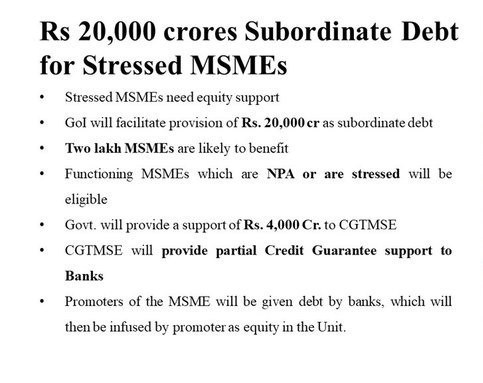

2) To provide stressed MSMEs with equity support, Government will facilitate provision of Rs. 20,000 cr as subordinate debt.

3) To provide stressed MSMEs with equity support, Government will facilitate provision of Rs. 20,000 cr as subordinate debt.

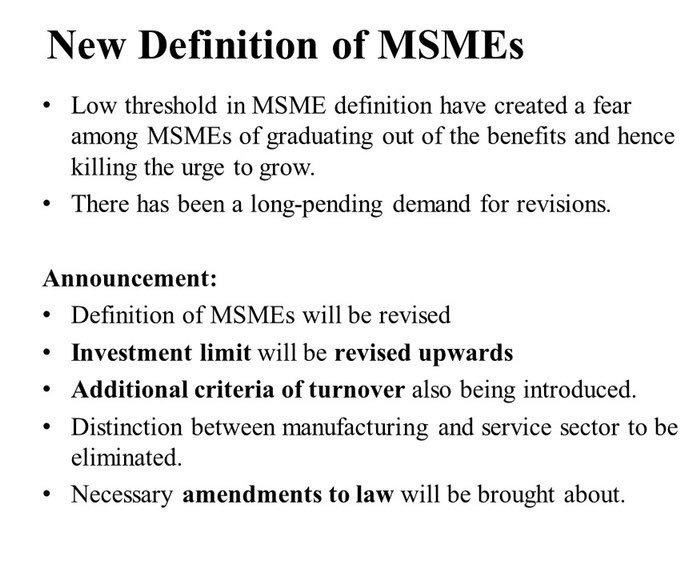

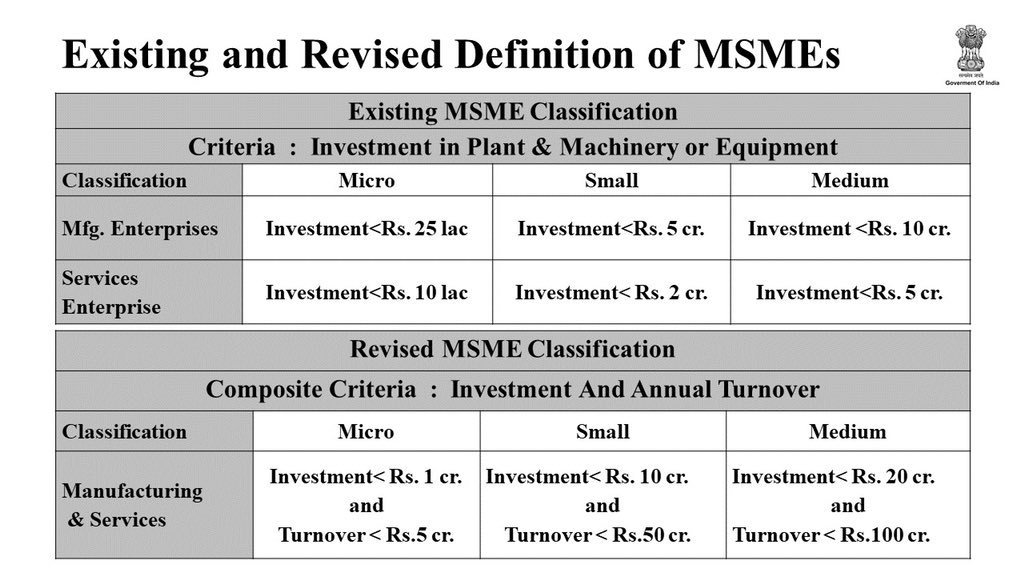

4) Definition of MSMEs gets a revision, Investment limit to be revised upwards, additional criteria of turnover also being introduced

The definition of MSMEs has been changed to help them continue to receive benefits. Investment limits that define an MSME have been significantly hiked, and additional criteria based on turnover size are being introduced. Differentiation between manufacturing and service MSMEs is being removed as part of Government support MSME 2025.

5) Unfair competetion from foreign companies to become a thing of the past; Global tenders to be disallowed in Government procurement upto Rs 200 crores

Global tenders are disallowed for tenders up to Rs 200 Cr for government procurement. The move is a booster shot for MSME business prospects and bidding for government contracts. In effect, MSMEs get preference in all central government business up to Rs 200 Cr, as part of MSME fiscal measures India.

6)Govt of India and Central Public Sector Enterprises will honour every MSME receivable in the next 45 days.

Seamless e-market linkages across the board will be provided to MSMEs, considering their inability to participate in trade fairs due to #COVID19.

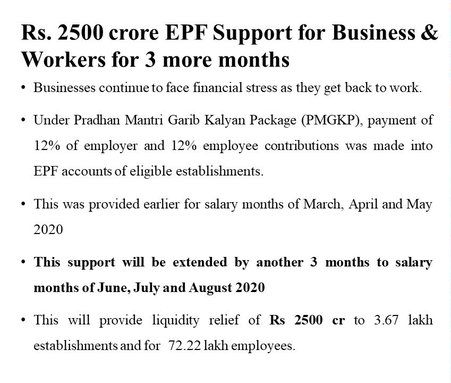

7) It has been decided to reduce statutory PF contribution of both employer and employee to 10% each from existing 12% each for next 3 months for all establishments covered by EPFO

8) In order to provide more take home salary for employees and to give relief to employers in payment of PF, EPF contribution is being reduced for Businesses & Workers for 3 months, amounting to a liquidity support of Rs 6750 crores.

9) Government launches a Rs 30,000 crore Special Liquidity Scheme for NBFCs/HFCs/MFIs

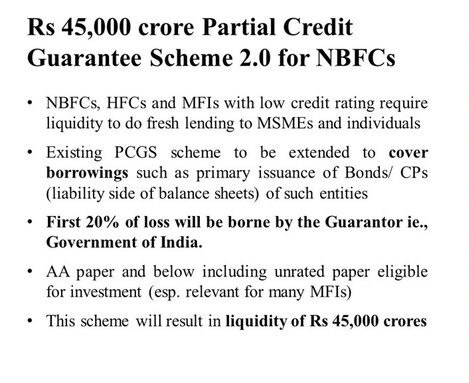

10) Government announces Rs 45,000 crore liquidity infusion through a Partial Credit Guarantee Scheme 2.0 for NBFCs

11) To give a fillip to DISCOMs with plummeting revenue and facing an unprecedented cash flow problem, Government announces Rs. 90,000 Crore Liquidity Injection for DISCOMs

PFC/REC to infuse liquidity of Rs 90,000 cr to DISCOMs against receivables. Loans to be given against State guarantees for exclusive purpose of discharging liabilities of Discoms to Gencos. Central Public Sector Generation Companies to give rebate to Discoms

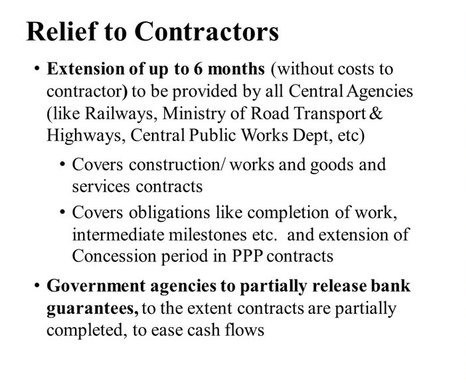

12) In a major relief to contractors, all Central agencies to provide an extension of up to 6 months, without cost to contractor, to obligations like completion of work covering construction and goods and services contracts.

13) will advise States/UTs and their Regulatory Authorities to extend the registration and completion date suo-moto by 6 months for all registered projects expiring on or after 25th March, 2020 without individual applications

14) TDS reduces by 25% from tomorrow till March 31 2021

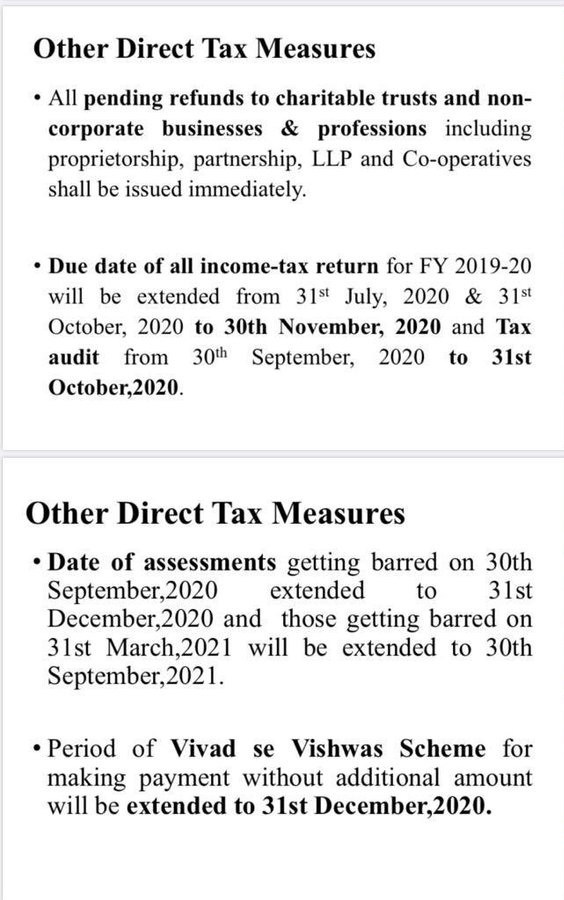

15) Due date of income tax return filling is extended .. from 31st July to 30th Nov and Tax Audit filling from 30th Sept to 31st October

16) Other Tax Measures

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

.svg)