INTRODUCTION

Time of supply means that point of time when goods/services are considered to be supplied. When the seller knows the ‘time’, it helps him identify due date for payment of taxes. Before finding out the relevant provisions under Time of Supply, it’s important to understand the due date for issuing a Tax Invoice, as this will assist in comprehending the concept—especially for service-based sectors like Supply of Manpower and Security Services to Government under GST..

Section 31 – Due Date of issue of Tax Invoice

In case of Goods

- In case of normal supply which is not on continuous basis:-

- Cases where there is movement of goods. For instance, Mr A from Mumbai is delivering goods to Mr B from Delhi.

- Cases where there is no movement of goods. For instance, Mr A owns a mobile shop. He sells mobile phones in his shop, over the counter only. Hence there is no movement of goods between the supplier and recipient.

- In case of normal supply which is on continuous basis

- In case of Sale on Approval Basis

Invoice to be issued on or before date of removal of goods by supplier

Invoice to be issued on delivery of goods (i.e when goods are made available to the recipient)

For instance, supply of LPG gas through pipelines is an example of continuous supply.

Invoice to be issued on or before, earlier of date of issue of statement or date of payment

Invoice to be issued within 6 months from the date of removal

In case of Services

- Other than Continuous Service

- Continuous Service (service which generally takes more than 3 months for its completion)

- If due date is ascertainable

- If due date is not ascertainable

- Services pertaining to any Event

Invoice to be issued within 30 days of provision of service (45 days for banking & insurance company)

Invoice to be issued on/before due date of payment

Invoice to be issued before/at the time the supplier of the service receives the payment

Invoice to be issued on/before completion of such event

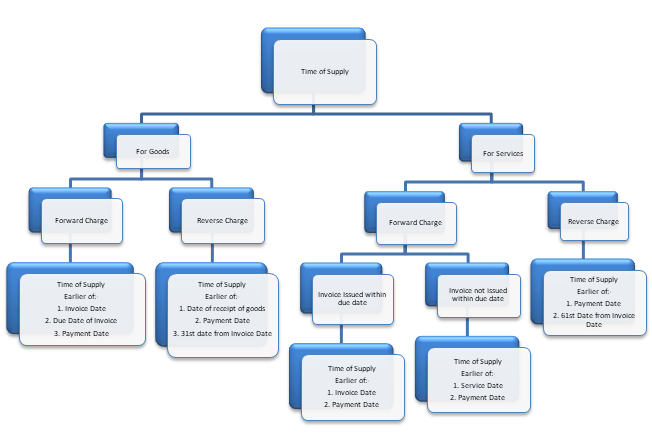

Let us now refer to the Time of Supply provisions under the GST Regime

In case of Goods

- Goods Taxable under Forward Charge

- Date of Invoice

- Due Date of issue of Tax Invoice u/s 31

- Date of Payment

- Goods Taxable under Reverse Charge

- Date of Receipt of Goods

- Date of Payment

- 31st date from the date of issue of invoice

Time of Supply is earlier of:-

For instance, Mr A sold goods to Mr B on 20th February. The invoice was issued on 15th February. The payment was received on 28th February. Last date on which invoice should have been issued is 20th February. Time of Supply in this case is 15th February.

Time of Supply is earlier of:-

If it is not possible to determine the time of supply, the time of supply shall be the date of entry in the books of account of the recipient.

In case of Services

- Services Taxable under Forward Charge if invoice is issued within the time limit

- Date of Invoice

- Date of Payment

- Services Taxable under Forward Charge if invoice is not issued within the time limit

- Date of Provision of Service

- Date of Payment

Time of Supply is earlier of:-

Time of Supply is earlier of:-

Let us understand the above two points with the help of an example:-

Mr. A provides tour operator services.

| Recipient | Date of provision of Service | Invoice Date | Payment Date | Is invoice issued within 30 days | Time of supply |

|---|---|---|---|---|---|

| X | 01/01/2020 | 10/01/2020 | 12/01/2020 | Yes | 10/01/2020 |

| Y | 01/01/2020 | 05/01/2020 | 03/01/2020 | Yes | 03/01/2020 |

| M | 03/01/2020 | 06/02/2020 | 12/01/2020 | No | 03/01/2020 |

| N | 03/01/2020 | 06/02/2020 | 12/01/2020 | No | 02/01/2020 |

- Services Taxable under Reverse Charge

- Date of Payment

- 61st date from the date of issue of invoice

- Services Taxable under Reverse Charge where Service Provider (outside India) is an associated enterprise

- Date of Payment

- Date of entry in books of accounts of recipient

Time of Supply is earlier of:-

If it is not possible to determine the time of supply, the time of supply shall be the date of entry in the books of account of the recipient

Time of Supply is earlier of:-

Time of Supply Provisions at a Glance

Common provision for Time of Supply

- In case of vouchers

- If supply is identifiable

- If supply is not identifiable

- In case of Special Items (interest, late fee, penalty for delayed payment of consideration)

- Residual Method

- Periodic Return has to be filed

- In any other Case

Time of Supply = Date of issue of voucher

Time of Supply = Date of redemption of voucher

Time of Supply = Date on which supplier receives such addition in value

If it is not possible to determine the time of supply by the above provisions, then it will be-

Time of Supply = Date on which return is to be filed

Time of Supply = Date on which GST is paid to the department

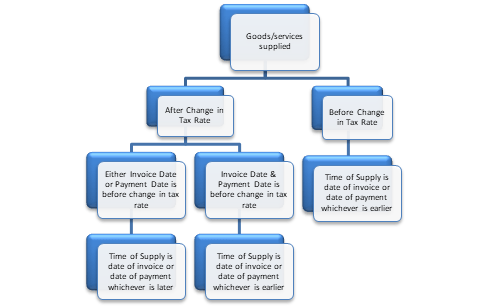

Time of Supply Provisions when there is a change in tax rate

Let us refer to the following example to understand the same:-

Tax rate changed from 8% to 12% of a particular service from 01/10/2019

| Date of provision of Service | Invoice Date | Payment Date | Time of supply |

|---|---|---|---|

| 25/09/2019 | 27/09/2019 | 02/10/2019 | 27/09/2019 |

| 03/10/2019 | 27/09/2019 | 02/10/2019 | 02/10/2019 |

| 03/10/2019 | 27/09/2019 | 25/09/2019 | 25/09/2019 |

Why Professional Utilities?

Professional Utilities simplify registrations, licenses, and compliances for your business. With experienced guidance and nationwide support, we help you complete every requirement efficiently and effectively.

Complete Corporate Solutions

PAN India

Assistance

Free Expert

Guidance

Google-Verified

Team

Dedicated Support

.svg)